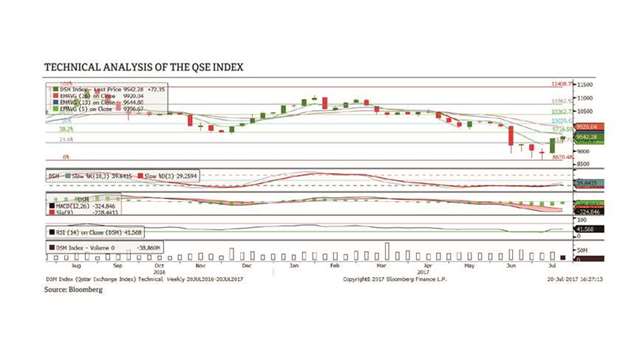

The QSE index rose 0.8% during the week to a level of 9,542.28. A hammer candlestick has been observed in the weekly chart which resulted, the index to cross the five day EMA level and is expected to rise further in the near future. Stochastics and RSI both are suggesting a positive trend in the upcoming trading sessions. Our support level remains at 8,670 and resistance level remains at 10,039.

Definitions of key terms used in technical analysis

Candlestick chart – A candlestick chart is a price chart that displays the high, low, open, and close for a security. The ‘body’ of the chart is portion between the open and close price, while the high and low intraday movements form the ‘shadow’. The candlestick may represent any time frame. We use a one-day candlestick chart (every candlestick represents one trading day) in our analysis.

Doji candlestick pattern – A Doji candlestick is formed when a security’s open and close are practically equal. The pattern indicates indecisiveness, and based on preceding price actions and future confirmation, may indicate a bullish or bearish trend reversal.