Stocks of copper registered with the London Metal Exchange (LME) jumped by a net 72,625 tonnes, or 30%, in the space of just four days starting June 29.

That was courtesy of whoever warranted 86,950 tonnes of metal in LME sheds.

It was the fourth time since December that LME copper stocks have been rocked by huge inflows.

All four “arrivals events” have been unprecedented in scale, and the cumulative inflow has been in excess of 500,000 tonnes.

The London aluminium market has grown accustomed to huge tonnages appearing and disappearing in the LME warehouse network.

But prior to last December the largest concentrated warranting in the copper market took place in February 2015, when 32,750 tonnes showed up on a single day.

These running stock shocks have obscured any coherent market narrative behind a lot of smoke and several mirrors.

Copper is a market that is collectively trying to work out whether it is in supply surplus or shortfall.

Opinions are divided.

The median forecast in the latest quarterly Reuters base metals poll of analysts was for a 17,000-tonne deficit for 2017.

Well, good luck trying to discern such a small market balance from LME stocks right now.

Don’t despair, however. There’s a bigger stocks picture which is generating a better signal of copper’s supply-chain dynamics.

It’s just that the LME’s part in that picture appears to be changing.

This latest “arrivals event” is just another whirl of a copper stocks merry-go-round that has been spinning for many months. The previous three spins took place in May, March and last December.

There was a precedent in August 2016 as well, although the warranting action in that month was more dispersed.

There are two common themes to all these stocks shocks. What enters the system does so primarily at Asian locations.

Cumulative “arrivals event” inflows have been concentrated on the ports of Busan in South Korea, Singapore, Kaohsiung in Taiwan and Port Klang in Malaysia.

The only exception has been Rotterdam, which has seen significant inflows over the same days. And what enters the system doesn’t stay around for long.

May’s “arrivals event” saw 126,150 tonnes warranted in just three days, boosting headline stocks to a six-month high of 354,650 tonnes. By the time of the most recent surge, however, they had fallen back to 243,300 tonnes. What’s going on?

A big bull-bear battle is what’s going on.

One rooted in physical flow, warehousing and arbitrage dynamics.

Metal is being relentlessly shuffled between LME and off-market storage and between geographic locations.

Reading the game is hard because most of it is taking place in the physical market shadows. This feud has also become a battle of market narrative, each player using LME stocks to express an opposing view.

The problem is that the smoke of battle has hopelessly distorted any stocks’ pricing signal, bullish or bearish.

An LME copper stocks chart right now looks like a badly drawn zig-zag.

And it’s getting worse, because this merry-go-round seems to be turning ever faster. There is some good news, though.

Firstly, it’s questionable just how much these games with LME stocks have impacted price.

LME three-month copper has held station in a broad $5,420-6,205 range since the start of December. Time-spreads, which should be more sensitive to stocks shocks, have largely held steady over the same period.

The benchmark cash-to-three months spread was valued at $28-per tonne contango at the close of Monday.

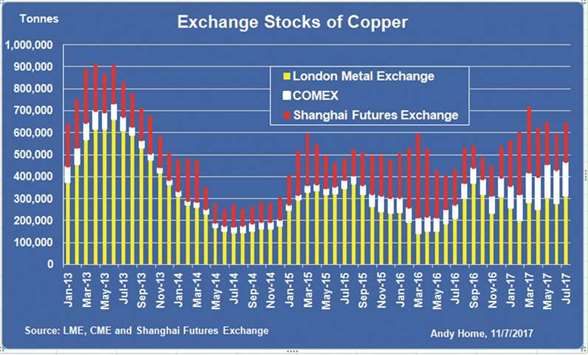

Secondly, LME stocks are only one third of the visible copper stocks picture.

The other two components are the Shanghai Futures Exchange (ShFE) and CME (COMEX). Taking all three together, as of last Friday the cumulative net change so far this year was a build of 114,040 tonnes.

It’s not an outlandish signal, factoring in both this year’s increased scrap availability and lower Chinese imports.

Nor is it dramatically out of line with the latest market balance assessment from the International Copper Study Group.

According to the ICSG, the global refined market recorded a supply surplus of 164,000 tonnes or, seasonally adjusted, 72,000 tonnes in the first quarter of this year.

*Andy Home is a columnist for Reuters. The views expressed are those of the author.

.