China is ramping up both imports and domestic production of natural gas, with the combined rate of growth running well ahead of the government’s target for boosting the use of the cleaner-burning fuel.

Official data for domestic production, imports via pipelines and imports of liquefied natural gas (LNG) show the total amount of natural gas available in China in the first five months of the year was the equivalent of 72.01mn tonnes of LNG.

This was up 9%, or 5.94mn tonnes, on the 66.07mn tonnes that were either pumped domestically or imported in the first five months of 2016.

China has set a target of increasing the share of natural gas in energy consumption from 5.9% in 2015 to 10% in 2020, an average annual increase of 4.1%.

So far this year, China’s output and imports of the fuel are running at more than double the annual rate needed to reach the official target.

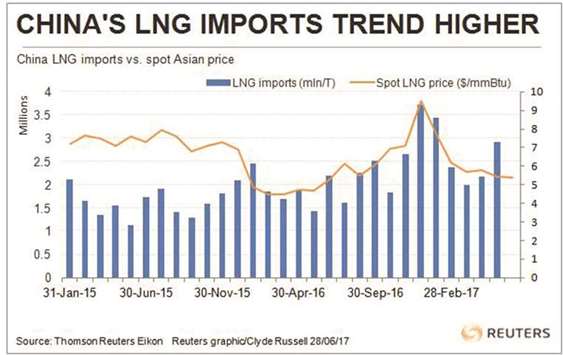

The biggest gainer has been imports of LNG, which are up 38.4% in the first five months of 2017 to 12.86mn tonnes, while pipeline imports have dropped 4.4% to 12.65mn tonnes.

Domestic natural gas production has been a strong gainer, rising almost 7% in the January to May period to 62.88bn cubic metres, equivalent to 46.5mn tonnes of LNG.

The rise in natural gas output stands in sharp contrast to the decline in crude oil production, which fell to the lowest on record in May as output declines from older fields. Natural gas has also outperformed coal, with domestic output of the polluting fuel up 4.3% to 1.4bn tonnes in the first five months of the year.

The jump in imports of LNG shows how the super-chilled fuel is becoming more competitive with pipeline imports from central Asia.

Customs data from May shows that the average landed cost of LNG was $7.28 per million British thermal units (mmBtu).

This is higher than the $5.25 per mmBtu of pipeline imports, however, the customs price excludes the cost of internal pipeline and distribution, meaning imports from central Asia still have to pay to get from the border to demand centres.

In contrast, much of the LNG is consumed near to where it is offloaded and re-gasified, meaning it doesn’t suffer from the additional costs associated with the pipeline imports.

Among China’s LNG suppliers Australia has fared best, with imports rising 42.7% in the first five months to 5.39mn tonnes.

Malaysia is the third-biggest supplier to China, with 1.82mn tonnes in the first five months, up 90% from the same period in 2016. The price being paid by China for LNG tells part of the story, with cargoes from Australia landing at $6.80 per mmBtu in May, slightly ahead of the $6.49 for Malaysia.

Australia’s price advantage is still largely tied to the 25-year supply deal from the North West Shelf venture, signed in 2002 at a fixed price of $3.80 per mmBtu.

At the time it was Australia’s biggest export deal and hailed as a breakthrough in accessing China’s markets, with former prime minister John Howard calling deal a “gold medal performance.”

Since then, as spot LNG prices first rose dramatically to peak at over $20 per mmBtu in 2014, the deal was seen as too generous to the Chinese, given it lacked any mechanism for re-negotiation or linking the price to crude oil, as is common in most long-term LNG contracts.

The spot price of Asian LNG was $5.40 per mmBtu in the week to June 23, down from the northern winter peak this year of $9.40 in early January.

This means China is still paying more for its LNG than the spot price, but not so much as to make LNG imports uncompetitive against pipeline supplies.

LNG imports in June appear set to remain robust, with vessel-tracking and port data compiled by Thomson Reuters Supply Chain and Commodity Forecasts showing 2.7mn tonnes has already been discharged, or is discharging, at Chinese ports as of Tuesday.

With three days still remaining in the month, the data suggests that an additional eight vessels carrying 560,000 tonnes may discharge before the end of June, taking total imports for the month to around 3.26mn tonnes.

While natural gas has policy support boosting its use in China, it remains more expensive than coal when used to generate electricity.

The best chance for natural gas to continue to make inroads is not only for LNG prices to remain relatively low, but also for the authorities in Beijing to push for natural gas to be used more in areas like residential heating and smaller factories, many of which still use coal.

* Clyde Russell is a Reuters columnist. The views expressed here are his own.

.