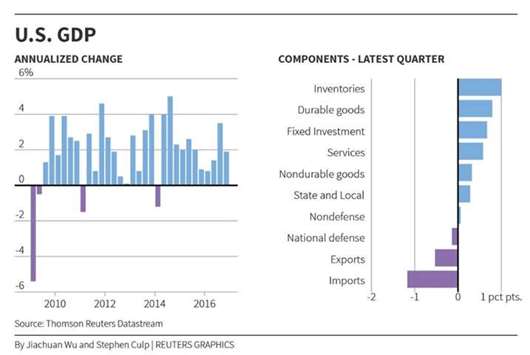

The US economy grew much faster than originally reported in the first quarter due to sharp increases in business and consumer spending, the Commerce Department reported yesterday.

The revised data show GDP growth in President Donald Trump’s first quarter was 1.2%, half a percentage point higher than the first report, which showed the US economy expanded at its slowest pace in three years.

While putting a far rosier finish on the January-March period, the result may cast doubt on the Trump administration’s pledge to boost annual US growth to 3%.

But the upward revision solidifies the expectation the Federal Reserve will raise interest rates again in June, since it confirms the central bank’s view that first-quarter weakness was only temporary — evidence of which it said would be needed prior to increasing the benchmark lending rate for the second time this year.

The quarter was still far slower than the final three months of 2016, when GDP grew 2.1%, but analysts say first quarters have trended low in recent years.

Economists said an array of factors held down the first quarter results, including lower utility spending due to unseasonably warm winter weather, delayed income tax refund payments, which dampen consumer spending, a March winter storm and a late Easter holiday.

Trump rose to office on an agenda of economic revival, and the administration is promising growth of 3% — though economists say this may be unrealistic.

The White House is counting on the robust expansion to pay for a proposed military buildup and multi-trillion-dollar tax cuts.

Nariman Behravesh, chief economist at IHS Markit, said business inventories and continued strength in consumer spending should put the second quarter above 3%, although that will not be sustained for the full year.

“Today’s numbers reinforce the IHS Markit view that the US economy is still chugging along at a 2.0 to 2.5% rate,” he said in a research note.

Businesses fixed investment rose at the fastest pace in five years and consumption was doubled to 0.6% growth, according to the revised data.

The GDP estimate, based on a more complete set of a data than was available in April, also reflected a smaller decrease in spending by state and local governments than originally reported.

The Commerce Department will revise the data again in June.

Economists may be expecting a rebound in the April-June period but a key indicator for the first month of the second quarter was only fair.

In a separate report, Commerce Department figures showed a dip in civilian aircraft sales helped depress orders for big-ticket US-manufactured goods in April, marking the first decline in five months.

The slowdown was smaller than analysts were expecting and appeared larger due to the steep upward revision in March orders.

Total orders for durable goods fell by 0.7% in April to $231.2bn, down from March’s robust 2.3% gain, and the slowest expansion since November.

The slowdown was smaller than analysts were expecting and appeared larger due to the steep upward revision in March orders.

The decline was largely driven by 9.2% drop in orders for civilian aircraft, but there were other signs of weakness, including capital expenditures which had the weakest reading in five months, falling 1.9%.

“Businesses are just not investing heavily and that could weigh heavily on second quarter growth,” economist Joel L.

Naroff said in a research note.

“If the economy is going to grow at 3% for as long as the eye can see, businesses better spend lots of money on capital goods.”

Ian Shepherdson of Pantheon Macroeconomics also noted the weak capital spending and said.”Second quarter GDP growth is going to be mostly a story of rebounding consumption rather than surging capex.”