No false dawn this time. After years of disappointments, European companies are finally living up to market expectations, enjoying their best season in almost seven years as earnings per share grow at more than twice the pace of their US counterparts.

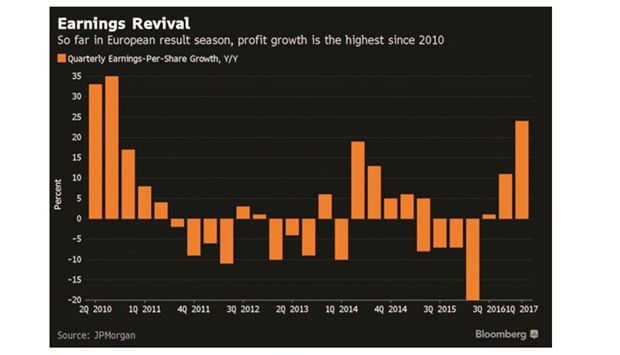

About a third into Europe’s first-quarter earnings season, companies listed on the Stoxx Europe 600 Index have so far reported a 24% jump in EPS year over year, on track to be the biggest rise since the third quarter of 2010, according to data from JPMorgan strategists Emmanuel Cau and Mislav Matejka.

European banks have been reporting particularly strong results, posting a 32% surge in quarterly EPS so far, the sector’s performance since the third quarter of 2014. Earlier on Friday, Swiss bank UBS Group reported a 80% jump in net income, beating analyst expectations and sending its shares up 3.5%. With companies benefiting from a return of inflation and improving economic growth, analysts are scrambling to upgrade their 2017 estimates for European earnings, instead of trimming their forecasts as they usually do this time of the year.

The region has endured a challenging pricing environment over the last five years, and now there are signs that some pricing power is returning, Citigroup equity strategists including Jonathan Stubbs wrote in an April 27 note that referred to purchasing managers indexes.

“There are signs that earnings trends are re-connecting with robust PMIs as commodity and bank drags reverse and as other industries also benefit from an improvement in European and global nominal GDP growth,” they wrote.

The earnings season has also been robust in the US, just not as strong as in Europe. So far, S&P 500 profits are up 10%, with growth in eight of 11 sectors.

EUROPE