French billionaire Bernard Arnault will combine the Christian Dior fashion brand with his LVMH luxury goods empire as part of a €12bn ($13bn) move to simplify his business interests — a restructuring long demanded by other investors.

Under a series of complex transactions, LVMH, the world’s largest luxury group, will buy the Christian Dior Couture brand from the Christian Dior holding company for €6.5bn, including debt.

The deal will unite the 70-year-old fashion label worn by film stars from Grace Kelly and Elizabeth Taylor to Jennifer Lawrence and Natalie Portman with the Christian Dior perfume and beauty business already owned by LVMH.

The Arnault family, which holds a 47% stake in LVMH, will also offer to buy the 25.9% of the Christian Dior holding company it does not already own for about €260 per share, a premium of 15% over Monday’s closing price.

The transactions “will allow the simplification of the structures, long requested by the market, and the strengthening of LVMH’s Fashion and Leather Goods division,” the 68-year-old Arnault said in a statement.

LVMH shares rose almost 5% to a record high of €225 as investors welcomed the deals, which they expect to boost LVMH earnings.

Dior shares also jumped 13% to a new high of €256. “This is a good acquisition for LVMH in our view given the strong brand of Christian Dior, good use of its balance sheet and it reunites the Christian Dior brand with the very profitable perfume operation that LVMH operates,” Barclays analysts wrote in a research note.

LVMH said it would use a loan to pay for Christian Dior Couture, which has 198 stores in over 60 countries, and whose sales have doubled over the past five years.

ExanebnP Paribas analyst Luca Solca welcomed “the long awaited LVMH and Dior merger”, which he said was made at a reasonable valuation.

Including debt, LVMH is paying 15.6 times Dior’s 2017 earnings before interest, taxes, depreciation and amortisation (EBITDA).

Solca added the deal also reduced the risk of LVMH, whose brands include Louis Vuitton and Hennessy cognac, buying pricey, “trophy assets”.

Finance chief Jean-Jacques Guiony declined to comment on LVMH’s future mergers and acquisitions (M&A) policy.

But Arnault told the Financial Times that LVMH was not hunting for acquisitions as “fewer and fewer assets are looking attractive to us.

And the best assets are not for sale.”

The Dior holding company owns 41% of the LVMH group and 100% of Christian Dior Couture, the home of the Lady Dior handbag.

Arnault’s family company will offer €172 per share and 0.192 Hermes shares for each Dior holding company share.

There are potential all-cash and all-share alternatives.

Arnault has a stake of about 8% in luxury group Hermes, and Hermes’ shares fell from earlier record highs on the prospect of more of the stock coming to the market.

LVMH said the overall deal would boost earnings per share by some 3% within the first year of its completion, with the transactions expected to close during the second half of 2017.

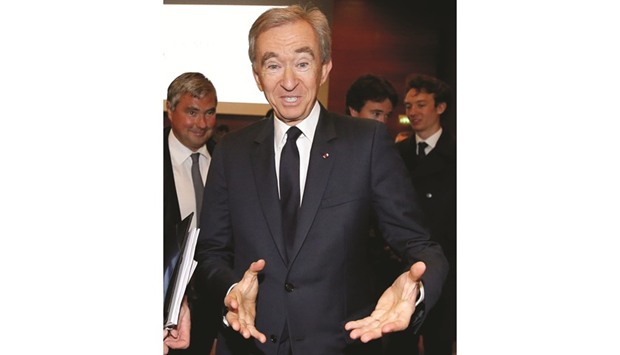

Chairman and CEO of Luxury goods group LVMH Bernard Arnault gestures after a news conference to announce a deal to simplify Christian Dior business structure in Paris yesterday.