Global stock markets edged higher yesterday, but investors were treading cautiously ahead of the upcoming French presidential election, while Wall Street was buoyed by a raft of corporate earnings reports, traders said.

“It was another jittery day for stock markets. Investors have been juggling multiple sets of corporate results while staying mindful of global geopolitics. That makes a strong directional move difficult,” said Jasper Lawler of London Capital Group.

After starting the session on a weaker footing as a result of the strong pound, London’s benchmark FTSE 100 index ended the day tentatively in positive territory.

Frankfurt’s DAX 30 index also crept higher, while the Paris CAC 40 added more than 1.5%.

“The risks surrounding the first round of France’s presidential election this Sunday have been keeping investors cautious,” said LCG’s Lawler.

The French CAC index made the strongest gains, led by banks BNP Paribas and Societe Generale.

Across Europe, London’ FTSE 100 was up 0.06% to close at 7,118.54; Frankfurt’s DAX 30 rose 0.09% to 12,027.32, while Paris’ CAC 40 was up 1.5% at 5,077.91.

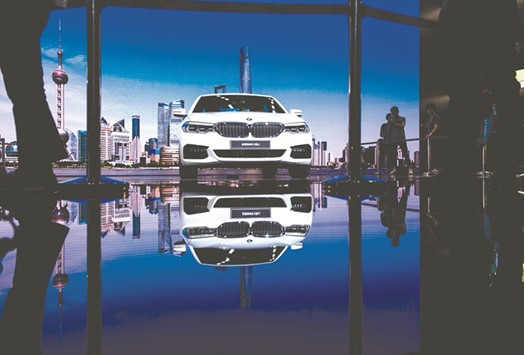

In Germany, carmaker BMW beat profit expectations with double-digit sales growth and 27% rise in pre-tax profits.

In London, “a mixed bag of corporate results kept the FTSE 100 near breakeven and still in negative territory for the year after its snap-election slump,” the expert continued.

Accendo Markets analyst Mike van Dulken said that the FTSE was “underperforming” as a result of the falling oil price and the unwelcome strength of the pound.

Eyes were also on the first round vote in the French presidential elections this weekend, with a four-way race making it tough to call who will go into the run-off.

There are fears a win for far-right leader Marine Le Pen, riding a wave of populism, could see the collapse of the eurozone after she said she would withdraw France from the currency bloc.

“World stock markets may be rangebound ahead of the first round of the French presidential election on Sunday, but the euro has hit a three-week high against the US dollar,” said Joshua Mahony at IG trading group.

Markets have been rattled in recent weeks by a series of events that upended the optimism that welcomed in the year.

Trump’s failure to push through key healthcare reforms last month dealt a huge blow to his chances of passing the tax-cutting, big-spending plan that had helped fan a global rally since his election win in November.

That was followed by a US missile strike on Syria – which hit US-Russian relations – and the ongoing sabre-rattling by North Korea that has fuelled worries about nuclear conflict.

An uninspiring Federal Reserve report on Wednesday on the US economy also failed to provide any lift.

“Geopolitical angst, a faltering US economy and the UK snap election are consuming investors mindsets,” said Stephen Innes, senior trader at Oanda trading group.

A BMW 5 Series Li car is presented during the first day of the 17th Shanghai International Automobile Industry Exhibition in Shanghai on Wednesday. BMW beat profit expectations yesterday with double-digit sales growth and 27% rise in pre-tax profits.