From dot-com catastrophe to safety trade. Such is the evolving role of technology shares measured by the Nasdaq 100 Index, whose combined value has swelled by $500bn this quarter, the most since the tech bubble peak in 2000. Computer and software makers lead the S&P 500 Index in 2017 and are favoured by active managers more aggressively than any other industry, according to a model used by Sanford C Bernstein & Co.

As in 2000, growth prospects explain much of the interest, with tech stocks offering profits that are expanding almost twice as fast as in the S&P 500.

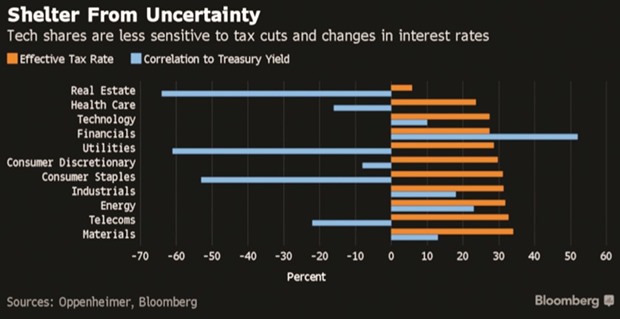

A deeper looks, however, shows a less typical attraction. At a time when uncertainty over monetary and fiscal policy is escalating, tech shares also serve as a shelter with less sensitivity to both changes in taxes and interest rates.

“Tech has a steady stream of earnings and less vulnerability on any given day to whatever is and isn’t happening in terms of what’s perceived as sea changes in government policy,” said Katrina Lamb, head of investment strategy and research at Bethesda, Maryland-based MV Capital Management, which oversees $600mn. “It’s traded on its own. It’s one of the cases where slow and steady wins the race.”

In a month when equities lost steam and questions arose over President Donald Trump’s ability to enact tax cuts, tech shares were the best performing group in the S&P 500, rising 2%. It’s a turnaround from the early stage of the post-election rally, where the industry lagged partly because of perceptions that it didn’t stand to gain from Trump’s domestic-focused policy.

Technology firms already pay lower taxes than companies in most other industries, partly due to a bigger share of overseas revenue. Their average effective tax rate of 27% trails only healthcare and real estate companies in the S&P 500, data compiled by Bloomberg show. As optimism over Trump’s agenda fades, the ability to boost earnings without the help of government policy has attracted investors. Companies such as Apple and Microsoft Corp are riding growing demand for smartphones and web-based services, with profits for the S&P 500 Information Technology Sector Index jumping 17% in the first quarter, analyst estimates compiled by Bloomberg show. Adding to the allure is the group’s insulation from interest rates.

While stocks of banks, real estate investment trusts and utilities have whipsawed over speculation about the Federal Reserve’s pace of tightening, tech stocks have shown little sensitivity to changes in 10-year Treasury yields over the past three years, according to Oppenheimer & Co.

.