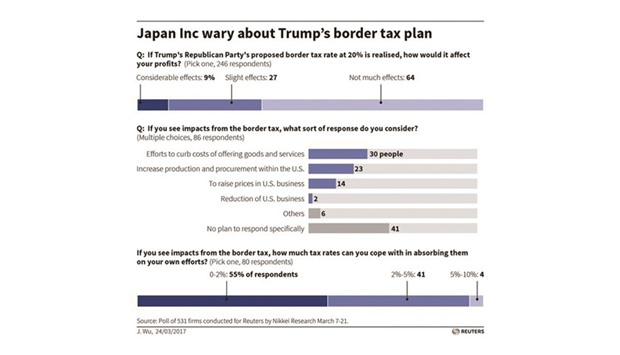

Japanese manufacturers are wary of a possible US border tax, with just over half expecting profits to take a hit if the United States slaps a 20% levy on imports, a Reuters poll showed

yesterday.

In response, they are thinking of cutting costs, increasing production and procurement in the United States and raising US product prices, but those steps would offset only some of the impact, the monthly Reuters Corporate Survey found.

The United States is the top destination for Japanese shipments.

The House Republicans’ proposal to tax imports at 20% could hurt Japan’s vital automobile, electronics and other exporters. “We’d have to consider setting up production facilities in the United States,” wrote a manager at a rubber company. “But in the longer term, it could lead to a shift away from the US for the manufacturing industry as a whole.”

In the monthly survey, conducted from March 7-21 for Reuters by Nikkei Research, 51% of the 129 manufacturers that responded said earnings would be affected. The ratio was highest among automotive-related firms, at 77%.

The figure is lower for Japanese companies overall, at 36% of the 246 that participated in the survey, which includes service-sector and other non-manufacturing firms that focus more on the domestic economy.

The plan for a border adjustment tax, backed by House Speaker Paul Ryan, is intended to encourage investment and manufacturing in the United States and pay for corporate tax cuts.

President Donald Trump, under his “America First” campaign, has called Japan’s auto trade “unfair” and is pressuring carmakers including Toyota Motor Corp to build more plants and create jobs in the United States.

Should such a tax be implemented, 28% of the manufacturers who expect profits to be affected would consider raising output and procurement within the United States.

Among automotive businesses, that figure climbs to 80%, the poll showed.

Critics of the border tax say it could be passed on to American consumers through higher prices, and the survey flagged potential hikes among some companies. Seventeen per cent of manufacturers would try to offset the impact on earnings through price increases, including 40% of electrical machinery firms, though just 10% of automotive companies would do so.

Meanwhile, 38% would deal with a tax through cost-cutting, the most popular choice. Overall, 72% of manufacturers would take some kind of steps to cushion the earnings blow.

Taro Saito, director of economic research at NLI Research Institute, said the percentage of companies anticipating an earnings hit was smaller than he had expected.

He questioned whether some were taking the tax plan seriously given that cost-cutting was the top choice.

“As the border tax plan becomes more of a reality, more businesses will shift to boost local production and procurement,” said Saito, who reviewed the survey results. “It’s such a big change in policy that companies will find it hard to come up with any countermeasures.

It’s simply impossible for companies to cope with a border tax rate of 20%,” he said. Indeed, the survey showed that no Japanese company would be able to offset a 20% border tax.

Just 4% would be able to cope with a tax rate of up to 10% and the remainder could offset up to just 5%.

jap