Rising short-term interest rates in the United States are prompting Lipper Award-winning bond fund managers to add emerging-market debt and non-agency backed residential mortgages that they say offer more potential for gains in the year ahead.

Managers from firms including AllianceBernstein, BlackRock and Thornburg Investment Management are bracing for further rate increases by the Federal Reserve, making US high-yield debt unattractive as highly-leveraged companies and municipalities have a more difficult time rolling over their debt costs.

Instead, managers say, emerging-market debt in countries like Brazil and Mexico that have slowly-stabilising economies and are undertaking structural reforms, as well as municipal debt issued by cities like Dallas that are in the centre of strong regional economies, look more promising.

“We are in a phase where diversification is going to be a big strategy” because there are fewer attractive assets given rising rates, said Gershon Distenfeld, portfolio manager of the AllianceBernstein High Income fund.”Our fund was up 15% last year and we don’t see that happening again.”

Distenfeld said that he now has about 40% of his portfolio invested in the United States, compared with 75% at this time last year.

He has been moving chiefly into both dollar and local-currency denominated securities in Brazil.

US high yield, by comparison, is “on the rich side now,” he said.

High-yield debt, for instance, suffered steep losses as investors moved to safer assets during Tuesday’s stock market sell-off, while emerging-market debt retained more of its value.

The Fed raised short-term interest rates for the second time in three months on March 15, and is widely expected to tighten again at least two more times this year.

Rising interest rates push down the price of older bonds with lower rates, eating into the returns of bond funds.

Mexico looks attractive given its economic reforms, said Bob Miller, the lead portfolio manager of the BlackRock Total Return fund.

The peso is regaining value following a steep decline after the unexpected victory of US President Donald Trump, Miller said.

He added that concern about more aggressive trade negotiations between the United States and Mexico “seems to have calmed down to a reasonable degree.”

Miller remained optimistic about the strength of the US economy.”There’s no obvious imbalance” that could point to a coming recession, he said.

Not every Lipper Award-winning bond fund manager is so upbeat, however.

Steve Kane, portfolio manager of TCW Core Fixed Income fund, said that he has just 2% of his fund in high-yield debt, and near zero of his fund in emerging-market debt, because he expects that the US economy is near the end of its expansion and a recession is becoming more likely.

He is still finding value in non-agency residential mortgages, however, because he sees “continuing improving fundamentals even if we reach an economic downturn” thanks to rising home prices and wage growth, he said.

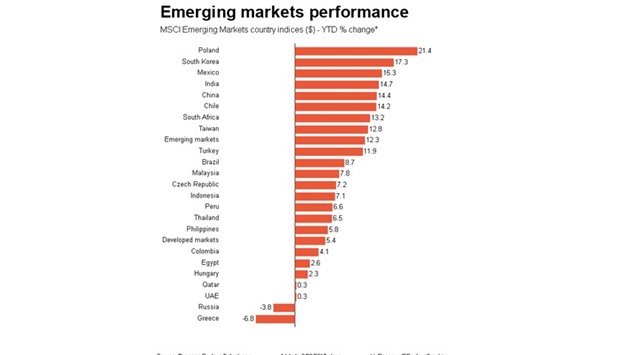

EMERGING