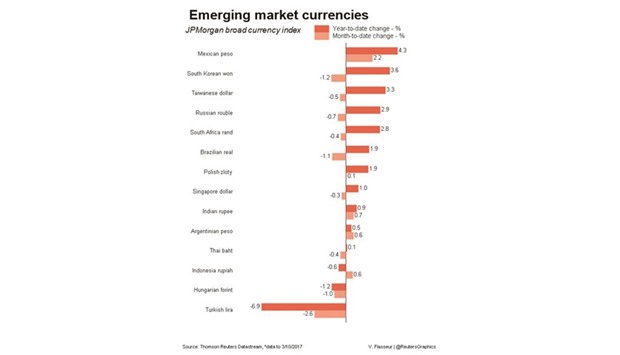

Emerging market currencies firmed as the dollar and US yields slipped from multi-week highs.

Markets have priced in an US interest rate rise when the Federal Reserve meets this Wednesday, a view cemented by robust US jobs data on Friday.

MSCI’s main emerging equity index rose 1% to one-month highs, tracking world stocks which cheered signs of a stronger US economy.

“The run-up to the Fed in terms of emerging market reaction is not dramatic anymore given that the market is basically pricing in a near 100% probability of a hike in March, so the market is already positioned for the outcome,” said Cristian Maggio, head of EM strategy at TD Securities.

Many emerging currencies firmed as the dollar slipped to two-week lows against a currency basket. The Indian rupee was boosted by a weekend regional election win for Prime Minister Narendra Modi’s pro-business ruling party, with many seeing the result as providing a green light for more reform.

While Indian markets were shut for a holiday, the rupee climbed to four-month highs in offshore trade while it rose around 0.5% in non-deliverable forward markets (NDF) with three-month NDFs hitting 15-month highs.

“This will strengthen PM Modi’s position and give him the political capital to press ahead with reforms. The results should be positive for Indian assets and the rupee near term,” Commerzbank analysts told clients.

The laggards of the day were the Russian rouble and Turkish lira, the former pushed down by an oil price retreat and the latter hit by tensions between Ankara and various European governments.

The lira slipped 0.3% and Turkish stocks fell half a per cent as the government summoned the Netherlands’ envoy to complain about what it called a “disproportionate” Dutch police response to pro-Turkey protests in Rotterdam.

Earlier President Tayyip Erdogan called the Netherlands a “banana republic”, stepping up anti-European rhetoric before an April referendum on increasing his powers. The political row overshadowed data showing a narrowing of Turkey’s current account deficit and attention now is on Thursday’s central bank meeting after it signalled it may tighten policy further if needed.

Its main funding rate currently stands at 10.8%, the highest since 2012. “The (central bank) has to be very mindful how the market is trading the lira, there is still a big net short position from the corporate sector against the dollar,” Maggio said.

Eastern European markets were broadly weaker, continuing to price in a potential rise in eurozone interest rates from 2018, as signalled by the European Central Bank last week. The Polish zloty slipped to six-week lows to the euro.

In bond news, Kuwait kicked off pricing on its long-awaited five- and 10-year benchmark deal at 100 and 120 bps over Treasuries respectively.

.