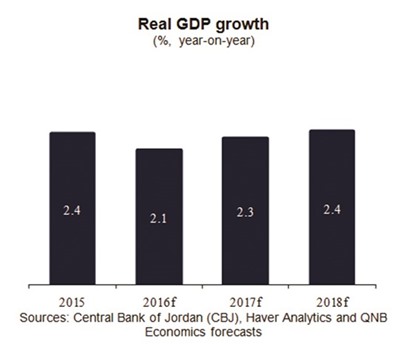

Jordan’s real GDP growth is expected to moderate in 2016 to 2.1% from 2.4% in 2015 to due to further fiscal consolidation, the impact of regional conflict, softening demand from China and the GCC for the kingdom’s exports as well as lower prices for these exports, a QNB report has shown. In its ‘Jordan Economic Insight 2016’ QNB said the kingdom has been resilient in the face of number of major shocks and fiscal consolidation programmes with the International Monetary Fund.

“As external conditions improve, growth is expected to gradually pick up,” QNB said.

Thereafter, Jordan’s real GDP growth should pick up to 2.3% in 2017 and 2.4% in 2018 as external demand for the country’s exports picks up.

Inflation is expected to remain in deflationary territory at -1% in 2016, driven by continued lower oil prices and currency strength dampening the cost of imported goods, QNB said.

However, QNB expects Jordan’s inflation to rise and stabilise at 1.9% in 2017 and 2018, reflecting the recovery oil prices and firming domestic demand, but constrained by currency strength.

QNB expects the country’s deficit to narrow in 2016 to 3.5% of GDP from 4.1% in 2015 on both higher revenues from the implementation of new tax measures and continued expenditure rationalization.

The deficit budget is expected to be stable around 3.7% in 2017 and 2018 as fiscal consolidation efforts are offset by expected higher energy spending as oil prices rise.

As a result, QNB expects Jordan’s public debt to reach 94.8% of GDP by 2018. The current account deficit is expected to widen in 2016 to 9.9% of GDP as declining foreign grants, exports and remittances outweigh the benefits of cheaper oil imports.

The current account deficit should hit 10% of GDP in 2017 before narrowing slightly to 9.6% in 2018, as an expected rapid rise in oil prices boosts import costs in 2017 faster than remittance and export growth, while in 2018, the latter factors should outpace a small rise in oil prices, narrowing the deficit, QNB said.

Business / Business

Jordan growth expected to pick up gradually; real GDP expansion seen at 2.1% in 2016, says QNB

.