Islamic finance continues to take the centre stage at global financial institutions. In early February, the International Monetary Fund’s (IMF) executive board held its first formal discussion on Islamic finance and adopted a set of proposals on the role that the IMF should play in this area. The fund concluded that Islamic finance presents an opportunity for many member countries to enhance financial intermediation and inclusion and mobilise funding for economic development. To utilise this potential, the fund says that there was a necessity to establish “a policy framework that promotes financial stability and sound development of Islamic finance in order to reduce systemic risks.”

In particular, the IMF saw merit in considering a proposal to formally recognise the “Core Principles for Islamic Finance Regulation for Banking,” prepared by the Islamic Financial Services Board, as a standard for the industry.

“We are looking forward to receiving a formal proposal for endorsement in the context of a forthcoming paper before end-April 2018,” the IMF says in a statement.

“We support the approach to developing and providing policy advice on Islamic banking-related issues in the context of fund surveillance, programme design and capacity development activities. We also support the work of the relevant international standard setters and other international bodies to help address current gaps in the international regulatory framework for Islamic banking,” the statement said.

Shortly after the IMF released its assessment of Islamic finance, the World Bank and the Islamic Development Bank (IDB) published their first “Global Report on Islamic Finance,” subtitled “A Catalyst for Shared Prosperity?” which focuses on the prospects of the global Islamic finance industry and its potential to help reduce worldwide income inequality, enhance and share prosperity, as well as achieve the United Nation’s Sustainable Development Goals.

“The report has been prepared with a focus on the widening disparity of global wealth and how Islamic finance can help in enhancing shared prosperity,” says Ahmed Mohamed Ali, president of the Islamic Development Bank Group.

“Given its potential role in economic development, Islamic finance can contribute toward achieving objectives of minimising disparity in wealth and enhance shared prosperity in order to reduce severe inequality that adversely affects economic growth and wealth creation and imposes social and environmental costs,” he adds.

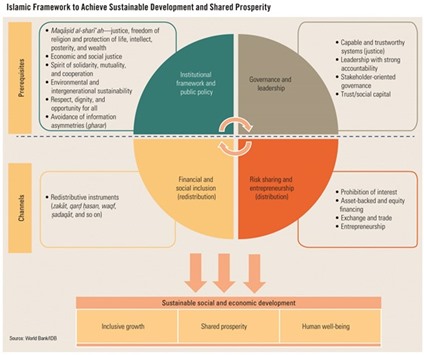

The report is based on the assumption that Islamic finance advocates for just fair and equitable distribution of income and wealth. Unlike conventional finance, Islamic finance is based on risk-sharing and asset-based financing. By making people direct holders of real assets in the real sector of the economy, it reduces their aversion to risk. And the strong link to the real economy is another core benefit. With those principles, Islamic finance could help improve the stability of the financial sector, the reports notes.

Apart from that, Islamic finance plays an important role in enhancing financial inclusion as it can bring into the formal financial system people who are currently excluded from it owing to cultural or religious reasons.

But, just as the IMF, the World Bank/IBD report points at the importance of establishing a strong regulatory regime to reach the full potential of Islamic finance. There should also be mechanisms in place to enhance harmonisation, implementation and also provide regulatory recognition of products from other jurisdictions to expand the markets through cross-border transactions, the report recommends.

It also advocates the creation of institutions that provide credit and other information to support equity-based finance, particularly for micro, small and medium-sized enterprises, and further develop capital market products and sukuk to help finance large infrastructure projects.

To achieve all these goals, Islamic finance should “go beyond banking,” the report notes, and support non-banking institutions which are currently underdeveloped or underutilised. This includes takaful operators with their risk-sharing, participation-based Islamic insurance products, as well as social finance organisations which could alleviate poverty by tapping into the potential of zakat and waqf, Islamic principles rooted in redistribution and philanthropy.

Business / Business

IMF, World Bank acknowledge Islamic finance as powerful development tool for members

.