Emerging market stocks fell yesterday although currencies mostly strengthened against a lacklustre dollar as investors awaited policy direction from the White House on a range of issues.

MSCI’s emerging market index fell 0.3% after tumbling nearly 1% on Friday, with bourses across much of Asia, South Africa, Russia and Greece chalking up losses.

Chinese mainland blue chips fell 0.8%, their biggest one-day loss for two months as Beijing’s security regulator ramped up its crack down on speculators.

Hong Kong shares slipped to 12-day lows.

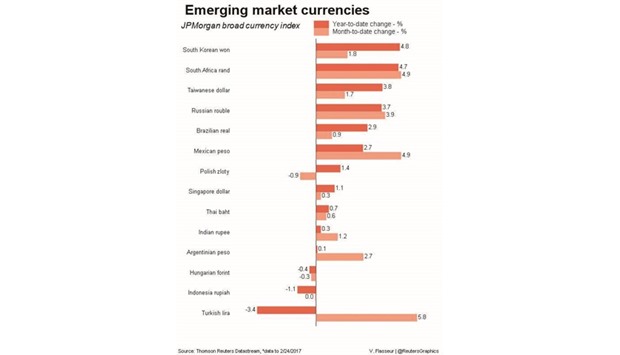

But currencies started the week on a brighter note.

Russia’s rouble recorded its biggest gain for two weeks, rising 1.3% and matching a jump in oil prices.

Turkey’s lira rose 0.5%, reversing some of Friday’s losses.

But China’s yuan and South Africa’s rand both weakened against the dollar.

“The dollar is trying to move higher and emerging markets currencies are very sensitive to 10-year US Treasury yields – if you have a sharp rise in 10-year yields you see quite a sell-off in emerging markets,” ABN Amro foreign exchange strategist Georgette Boele said.

Much of investors’ focus was today, when US President Donald Trump is scheduled to speak to a joint session of Congress and unveil some elements of his plans to cut taxes and boost infrastructure spending.

JP Morgan analysts told clients they expected Trump’s speech to “probably contain more negative EM language” though no dramatic anti-trade actions but that they were generally waiting for announcements on US trade policy to determine how these would affect emerging markets.

“This year, emerging market assets have been outperforming, putting managers in a bind: Do we keep waiting for the eventual anti-emerging market US trade measures, or were all these threats just a negotiations tactic that will eventually lead to growth-positive compromises?” they said in a note.

In Israel, policymakers are expected to leave short-term interest rates unchanged at 0.1% for a 24th straight month amid benign inflation partly due to a strong shekel, with the central bank having intervened to contain the currency.