Hampered by persistent political risks and sluggish economic growth, Europe’s equity markets have disappointed investors for years.

But some fund managers, cheered by the brightest outlook for European corporate profits since 2010 and valuation discounts that are becoming harder to ignore, are looking to snap up the bargains on offer — and taking a particularly close look at automakers, builders and German bluechips.

Political worries compounded by a series of uncertain national elections in Europe this year are sometimes cited as a factor holding investors back.

Yet for those who have drawn lessons from how European stocks reacted last year to the Brexit vote, Donald Trump’s US election win and a referendum on constitutional reforms in Italy, time looks ripe to prepare the buying campaign. While each event caused a market shock, its impact was increasingly short-lived and the snapback to fresh highs was swift.

“We will aim to take advantage of market volatility to buy good quality stocks at unwarranted discounts,” said Philip Dicken, European equities head at fund manager Columbia Threadneedle Investment fund, who expects the economic recovery in the region to continue and earnings to rise.

Earnings for constituents of the STOXX 600 index are expected to grow 14% this year, according to Thomson Reuters data, against 10% for the US benchmark S&P 500.

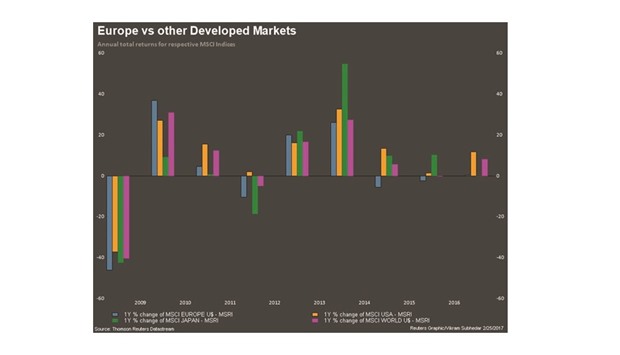

European stocks have lagged Wall Street over the last five years, leaving them a tenth cheaper on a price-to-earnings basis, a value gap which UBS said is the “biggest in the world”.

Yet Europe remains an uncrowded market and any jitters ahead of elections in France and Germany could be buying opportunities, analysts say.

Morgan Stanley on Thursday recommended investors buy European stocks and French banking shares, adding that fears of a far-right presidential election win were likely overdone.

German blue chips look another promising bet. The DAX, at 13.3 times forward earnings, trades at a discount to its long-term average valuation of 14.6. Heavily geared to stocks that benefit from economic recovery, the index also proved to be a safe harbour when the euro fell sharply and bond yield spreads shot up during Europe’s sovereign debt crisis six years ago.

As a hedge against a populist vote in France, JPMorgan strategist Mislav Matejka has recommended investors buy the DAX and short the French blue chip CAC index.

On a price earnings basis the CAC is 6% more expensive than the DAX.

“German equities will be a relatively safe haven within (the) eurozone into the (French) election if uncertainty remains and a clear relative winner” in the case of victory by far-right leader Marine Le Pen, Matejka said.

Others are also upbeat about the DAX, and DZ Bank Chief Investment Strategist Christian Kahler in Frankfurt expects the index to climb to record highs this year.

JPMorgan is overweight on autos, financials and energy and has a buy recommendation on German plays like carmaker Daimler and insurer Allianz.

Analysts at UBS highlight French builder Vinci and carmaker Renault, Italian oil major Eni and Norwegian phone group Telenor as attractively valued stocks that have lagged the recent rally.

In another sign the tide may be turning, some US funds and large investment banks have set their sights on Europe, having been scared away last year by Brexit and Italy’s political troubles.

Earlier in February BlackRock raised its outlook on European stocks to the highest possible rating for the first time since last May, saying risks were overblown. For now, greater interest for European stocks from the other side of the Atlantic, where most of the big global investors are based, has yet to translate into heavy buying.

Europe’s busy election year only compounds worries over its exposure to possible trade wars prompted by protectionist noises from Trump, but some investors expect that, as the political hubbub fades, volumes and prices could pick up.

Tempted by bargains on offer in the aftermath of the eurozone debt crisis, US investors were key buyers of European equities from 2012 to 2014.

And they could make the difference if they step in again. Albeit from a low base, global fund managers increased their exposure to the eurozone in January more than any other investment category, according to a Bank of America Merrill Lynch survey.

“We could be in the early days of a trend,” said BlackRock Managing Director Emanuele Bellingeri, who heads the group’s Exchange Traded Funds business, iShares, in Italy.”Even though big flows are still missing, conditions for a European revival are all there”.

FUND