On track for healthy weekly gains, emerging markets hit a soft spot yesterday with stocks pulling back from a 19-month high and currencies struggling to make headway against a tepid dollar as lower commodity prices and questions over US policy weighed.

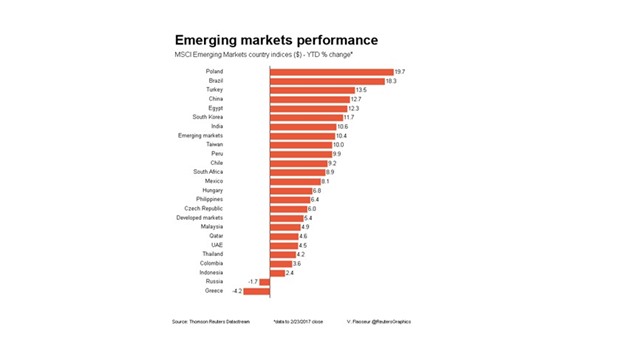

MSCI’s emerging market benchmark fell 0.4% with bourses in Hong Kong, South Korea, Russia and South Africa down more than half a per cent.

Yet the index was also on track for a weekly rise of around 1%, having gained eight out of the nine last weeks.

Despite the dollar slipping for a third day, currencies such as South Africa’s rand, Russia’s rouble, the Turkish lira and Mexican peso all weakened against the greenback.

China’s yuan joined the falls, unfazed by President Donald Trump ratcheting up the rhetoric again and declaring Beijing the “grand champions” of currency manipulation.

Trump’s comments came just hours after his new Treasury secretary vowed to stick to a more methodical approach to analyzing China’s foreign exchange practices.

Meanwhile Beijing said it had no intention of using currency devaluation to seek advantages and retorted China was a “grand champion” of economic development.

“At the moment we are in a sort of no mans land as far as markets are concerned,” said Simon Quijano-Evans, emerging markets strategist at Legal & General Investment Management.

“Since Trump’s inauguration it’s been a bumpy ride and if we focus on what he has been saying about China, the intention to charge US firms abroad taxes, the narrative on Mexico — it seems very clear these policy aims have been set in stone and it’s a question for waiting for them to happen.”

Despite the falls on the day, most currencies had a strong run over the week.

The lira looked to add 1.5% in its fourth straight week of gains.

The rand nearly matched the gains in its second week in the black after having hit its strongest level in 18-months earlier in the week after Finance Minister Gordhan delivered a budget targeting the wealthy with tax hikes in a bid to trim the budget deficit amid disappointing growth and very high unemployment.

Policy makers at Colombia’s central bank are expected to keep interest rates at hold at 7.50% expectations for inflation remain high, putting at risk their target for this year.

Investors were also awaiting ratings agency Fitch’s review of Azerbaijan and Greece, while S&P is expected to publish its latest assessment of Hungary and Iraq.