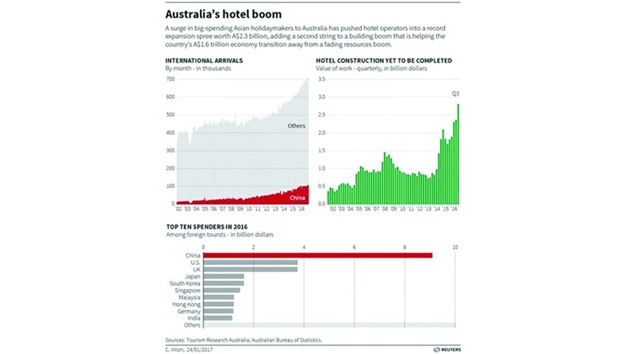

The hole in Australia’s economy dug by China’s dwindling appetite for its resources is being filled by the Chinese themselves, whose growing affluence is powering a surge in travellers in a boon to tourism income and growth.

Emboldened by the flood of big-spending Asian tourists, Australian hotel developers have embarked on their biggest expansion ever.

Tourism has already overtaken coal as Australia’s second-largest export earner, growing at an annual 13% to A$47bn in the third quarter of last year.

The travel surge is not new, but it is only now that visitor demand is pushing room and occupancy rates through the roof, encouraging hoteliers to make the expensive decision to add capacity.

“I have no hesitation at all to build new rooms,” said Jerry Schwartz, who will open a 590-room hotel in Sydney under franchise for AccorHotel’s’s Sofitel chain in September.

“Since income has got so positive I like to plough some of the money back in.”

The new Sofitel, on the waterfront at popular tourist site Darling Harbour, is the city’s biggest new hotel project since the Sydney 2000 Olympics.

Schwartz agreed in 2014 to acquire it from developer Lendlease for A$360mn ($272mn). It is one of around 120 new hotel projects in the pipeline across the country, which will help boost room capacity by as much as 30% over the five years to 2021, according to Tourism Accommodation Australia.

Blessed with an abundance of mineral resources that have helped it extend a remarkable run of 25 years of uninterrupted growth, Australia’s A$1.6tn economy is in the midst of a challenging transition away from a once-in-a-generation mining boom.

Now, as China’s voracious appetite for Australia’s commodity exports ebb, the nation has deftly positioned itself as an attractive destination for Chinese tourists – most of them well-heeled and eager to splurge on creature comforts.

The resulting spurt in construction activity – expected to boost broad economic growth by a half a percentage point over the next year – provides a welcome relief to policy makers who have been hoping for a revival in other sectors.

“Tourism has been a bright spot for the Australian economy, and we expect it to continue to add to GDP growth as 2017 unfolds,” said UBS economist Scott Haslem.

Indeed, the value of approved construction work for short-term accommodation catapulted to a record A$2.8bn in the September quarter.

Deloitte Access Economics estimates the pipeline of tourism-related projects at nearly A$20bn.

Lured by cheaper airfares and a lower Aussie dollar, holidaymakers from China are increasing at double the rate of the tourism sector, smashing forecasts and tripling the spending of next source of visitors, the United States.

Average international fares have fallen 7% since June 30, according to Australia’s top listed travel agent, Flight Centre.

Official data shows Chinese arrivals soared about 300% over the decade to June 2016 to top 1mn, and spending over that period jumped more than six times to A$6.6bn.

Over the past decade Chinese ‘high spenders’ – with total expenditure of A$4,200 or more – have been steadily increasing.

Nearly half of them arrived in Australia on a travel package and group tour, according to a 2015 study by Tourism Research Australia, for the period between 2005 and 2013.

That has lifted average room occupancy of hotels and motels across Australia to a record high of nearly 67% in the September quarter.

In Sydney and Melbourne – top tourist destinations-occupancy rates are as high as 90%.

Hong Kong’s Far East Consortium, Marriott, Intercontinental Hotels, Starwood and homegrown Crown Resorts are all expanding in response to this crunch point.

There are cautionary tales about hotel expansion in Australia.

The last two construction booms, for the Sydney 2000 Olympic Games and to meet Japanese tourist demand in the 1980s and early 1990s, were followed by busts as too many rooms were left chasing too few visitors.

“In terms of supply, it’s a double-edged sword,” said Olivier Coloun, investment analyst, at fund manager BT Investment Management, which is the largest shareholder in Mantra, Australia’s biggest resort operator.

“Obviously you don’t want supply to grow too quickly because that can depress room rates and occupancy.”

All the same, most in the industry say the China-led boom has a long way to run.

“Those travellers are looking for a deeper, richer experience – they will often stay longer, they’ll use the food and beverage, they’ll try the local wines,” Bob East, the chief executive of Mantra, told Reuters.

“Their engagement is far deeper and richer.”