Russia will resume buying dollars next week for the first time since a brief burst in 2015, but sources told Reuters the purchases will go ahead only after a reluctant central bank won assurances it could distance itself from the operations.

People involved in discussions of the planned purchases said the bank had feared investors would regard them as currency interventions designed to weaken the rouble, rather than the stated intention of replenishing Russia’s fiscal reserves depleted by low oil prices and international sanctions.

The central bank, which has a policy of letting the rouble float freely, insists it is not intervening in the foreign exchange market to influence the currency’s rate.

Instead, it said last month that it would merely buy the dollars on behalf of the finance ministry, which came up with the plan following a modest uptick in oil prices over the past year.

Nevertheless, the purchases may still create a dilemma for the central bank by putting downward pressure on the rouble after a period of relative calm.

Already, the currency suffered its biggest one-day drop so far this year on January 26, when the operations were announced.

The rouble was one of the best-performing currencies globally in 2016.

However, the government would stand to benefit from a weaker currency as it means oil revenues earned in dollars would translate into more roubles, allowing it to boost spending.

That would be especially helpful in the run-up to elections next year, when President Vladimir Putin is likely to seek a new term.

Describing discussions before the announcement between the bank, finance ministry and Kremlin, three sources said the central bank had had misgivings that buying dollars would hurt its reputation on financial markets.

Governor Elvira Nabiullina had worried she would have to justify the new round of interventions, one former government official familiar with the matter told Reuters. “But the finance ministry offered a life line by taking responsibility.

Now she won’t have to answer uneasy questions,” said the source.”She will say it was the finance ministry’s decision, it’s their money, and we are just acting as an operator.”

The finance ministry announced yesterday that the central bank would buy the equivalent of 6.3bn roubles ($106mn at current market prices) a day on the Moscow Exchange this month to replenish the country’s fiscal reserves.

The announcement covers purchases to be made between February 7 and March 6. Many investors credit the bank with steering Russia through an economic crisis since 2014, and view it as a bastion of sober policy-making in an otherwise hard-to-predict Russian system.

A spokeswoman for Prime Minister Dmitry Medvedev said the government has no “levers of pressure” on the central bank, while Kremlin spokesman Dmitry Peskov said Putin gave no orders to the bank to start dollar buying.

The bank last bought dollars on the domestic market in mid-2015 in a short-lived attempt to replenish its reserves, halting them to ease downward pressure on the rouble.

Russia’s economy was badly hurt by the combined effects of plunging oil prices in 2014-2015 and Western sanctions imposed over the Ukraine crisis.

Its Reserve Fund shrank to just $16bn by early February from nearly $90bn before Moscow’s annexation of Crimea in 2014 as the country spent the money to plug holes in the oil-dependent budget.

The International Monetary Fund has welcomed the finance ministry plan as it should help to rebuild reserves, improving predictability of fiscal policy.

However, it said the budget needed a “more comprehensive oil framework”. Despite the central bank’s efforts to keep the purchases at arms’ length, it may struggle to dispel the perception of currency intervention.

“This is indeed a step away from a free float.

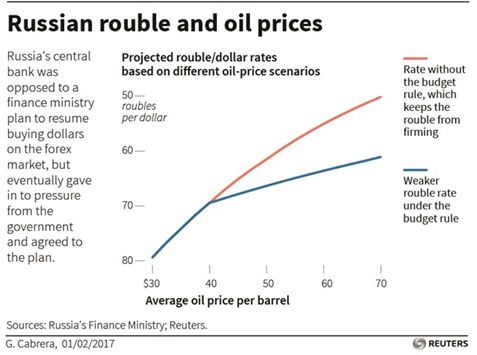

They are doing the right thing, presenting this as an (action by) the finance ministry, not the central bank,” a person close to the decision-making process in the Kremlin said. The purchases stem from a budget rule adopted in January. Under this, extra revenues from oil exports would be directed towards rebuilding the Reserve Fund.

That means selling roubles on the currency market to buy foreign exchange. While from a fiscal point of view that makes sense, according to several economists, it will have a knock-on effect on monetary policy.

According to finance ministry projections, the currency transactions required to implement the budget rule will push the rouble down. A weaker rouble could increase inflation and thus delay an economic recovery by prompting the central bank to postpone interest rate cuts.