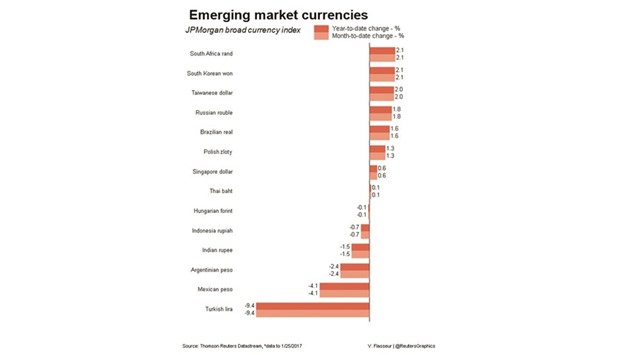

Emerging stocks hit three-month highs yesterday, boosted by US shares roaring higher, but currencies weakened led by a fall in the rouble after Russian authorities announced steps to increase central bank reserves.

MSCI’s emerging market index rose 0.7% in its fourth day of gains, after solid US earnings and expectations of a large fiscal spending package hoisted the Dow Jones Industrial Average over the 20,000 level for the first time and gave a fresh impetus to global equity markets.

Bourses in Hong Kong, India and Moscow jumped more than 1% while stocks in Turkey and much of emerging Europe also posted strong gains.

Emerging currencies, however, failed to advance as the dollar inched off six-week lows.

The rouble weakened 0.7% against the greenback, extending losses from Wednesday, when Moscow announced it would start buying foreign currency in February in line with a budget rule designed to shield the economy from swings in oil prices.

Analysts said the decision reflected concern over the rouble’s appreciation after it rose almost 20% last year.

“(The rouble) does reflect these various announcements about FX intervention,” said Paul Fage, senior emerging markets strategist at TD Securities.

“It will make the rouble less sensitive to oil price moves.”

Turkey’s lira fell 0.75% for its third day in the red, lurching closer towards a record low hit earlier in January.

The falls reflect investor fear that the central bank will not adequately tighten policy to defend the currency after a rate hike earlier in the week seen as insufficient.

Separately, Deputy Prime Minister Nurettin Canikli urged banks to lend to firms showing the “slightest sign of life” and said the economic recovery had begun.

South Africa’s rand weakened 0.5% while Ukraine’s hryvnia slipped 0.2% ahead of a central bank meeting where policymakers are expected to sit tight.

Meanwhile, the Mexican peso held steady against the dollar after recording its biggest daily gains in more than two months on Wednesday, when Trump said the country’s economic future was important to the United States even as he forged ahead with plans for a new border wall.

“(The Mexican peso) has been surprisingly resilient but there is no question that the country will be facing the biggest challenges from the shift in US policy,” Simon Quijano-Evans, a strategist at Legal & General Investment Management, wrote in a note to clients.

Mexico will release December trade data later in the day.

.