Business activity in Egypt shrank for the 15th consecutive month in December, although at a slower pace than the previous month, as inflation caused purchase costs to rise at a near-record pace, a survey showed yesterday.

The Emirates NBD Egypt Purchasing Managers’ Index (PMI) for Egypt’s non-oil private sector registered to 42.8 points, below the 50 mark that separates growth from contraction.

The index showed new orders dropping at a slower pace of 38 points compared with 36.3 in November as inflation rose and the Egyptian pound weakened against the US dollar.

Egypt has contended with a shortage of dollars that has made its black market the primary source of hard currency since a 2011 uprising scared off foreign investors and tourists, key sources of dollars.

The central bank floated the pound on November 3 and it has now weakened to around 19 pounds per dollar.

“If there is a silver lining to be found in this latest report, it is that new export orders decreased at the slowest pace since September 2015,” said Jean-Paul Pigat, senior economist at Emirates NBD.

An output-prices sub-index eased from November’s record 66.7 points was still at 63.5 in December.

Purchase costs came in at 90.8 points in December, compared with 93.5 in November.

New export orders were 47.8 points in December compared with 44.3 points in November.

“Although the process will not be immediate, a weaker Egyptian pound following November’s devaluation will eventually help boost export growth, which will clearly be welcome as the rest of December’s survey continues to point to weak domestic demand,” he said.

Egypt reached a preliminary agreement with the International Monetary Fund in August for a three-year $12bn loan programme to help plug its financing gap and stabilise the currency.

The deal was finalised in November.

The PMI showed employment declined for the 19th consecutive month in December, to 46.5 points from 45.1 points in the previous month. Egypt’s official unemployment rate was 12.5% in the second quarter.

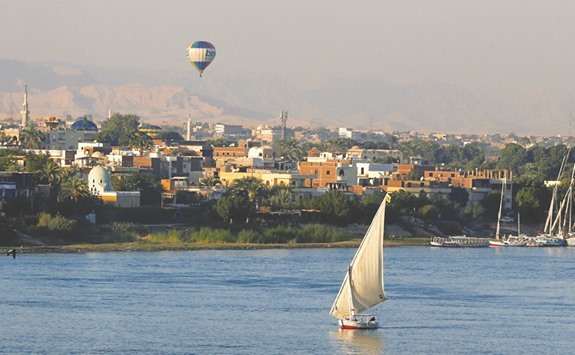

A balloon is seen above the Nile River as boats wait for tourists in the port city of Luxor, south of Cairo. Egypt has contended with a shortage of dollars that has made its black market the primary source of hard currency since a 2011 uprising scared off foreign investors and tourists, key sources of dollars.