Emerging market stocks climbed the most in a month yesterday, as Russia’s approval of the sale of a €10.5bn stake in its largest oil firm sent Moscow shares to a record high and forecast-beating Chinese trade data lifted the mood.

MSCI’s emerging market index jumped 1.3% in the wake of China reporting upbeat trade figures, with exports and imports both beating forecasts.

The European Central Bank was also expected to extend its already generous €1.5tn stimulus programme later.

That could help offset some of the pressure on EM assets if US interest rates rise next week as expected. “The trade data is giving an extra boost to emerging markets today but it’s part of a broader trend,” said Per Hammarlund, chief emerging markets strategist at SEB. “People have started to get used to (US President-elect Donald) Trump being in office and the Fed hike is pretty much fully priced in. Commodity prices have continued to go up, and that sentiment is also starting to affect emerging markets.” China’s data as well as a softer dollar in the currency markets had given most emerging Asian markets a solid lift overnight, although notably not those in China itself.

Russian rouble-denominated stocks then hit an all-time high after Moscow said on Wednesday it sold a €10.5bn ($11.3bn) stake in oil giant Rosneft to Qatar and commodities trader Glencore.

Shares in Russian oil giant Rosneft lept yesterday after the Kremlin announced the €10.5bn ($11.3bn) sale of a stake to commodities trader Glencore and Qatar’s sovereign fund.

President Vladimir Putin late Wednesday hailed the surprise deal for 19.5% of the state-controlled firm as the largest in the global energy sector for 2016, a major fillip for the strongman leader as he seeks to plug the country’s growing deficit.

The sell-off is part of a broader privatisation drive and comes despite Moscow being mired in Western sanctions over the crisis in Ukraine that have played a major part in plunging the country into recession.

Rosneft stock was up some 5% by 1100 GMT on the Moscow Exchange to 374 rubles ($5.9, €5.5), valuing the company overall at around €58bn.

Swiss-based Glencore and the sovereign fund of Qatar will go fifty-fifty on the deal, which leaves the Russian state controlling just over 50% of the country’s largest oil firm.

The sale of the stake in Rosneft was long in the pipeline but up until the last minute most observers expected the company itself to buy the shares from the government.

Rosneft chief Igor Sechin told Putin on Wednesday the firm had taken part in talks with “more than 30 companies, funds, professional investors, sovereign funds, financial institutions from countries in Europe, the Americas, the Middle East and the Asia-Pacific region” ahead of the deal. Not only was the money considerable, but the deal also confounded expectations that the Kremlin’s standoff with the West might scare off major investors from such high profile assets.

Having been buffeted rather than battered like many emerging markets by Trump’s US election win, central and eastern Europe were bracing for the next move from the ECB later yesterday.

Moves by the ECB tend to influence CEE countries like Poland, the Czech Republic, Hungary and Romania because the eurozone is so close and such a big market for local companies.

The central bank is expected to extend its money printing programme until at least next September. Polish stocks briefly surged to a six-month high in Warsaw as state-controlled firms also announced a deal to buy out Italy’s UniCredit’s Polish arm. The deal ended months of uncertainty. “The historic exit from Poland by a major Italian bank marks a turn that reflects an EU-wide home-bias tendency,” said Simon Quijano-Evans, strategist at Legal & General Investment Management, in a note. EM currencies were generally higher against the backdrop of a softer dollar, though the euro was climbing which meant it was higher against the likes of the zloty and Hungary’s forint.

The South Korean won and the Taiwan dollar climbed near one-month peaks. Indonesia’s rupiah meanwhile raced to a near four-week high on solid demand for local bonds among foreign investors. Bucking the trend, the Chinese yuan edged down on local corporate dollar demand.

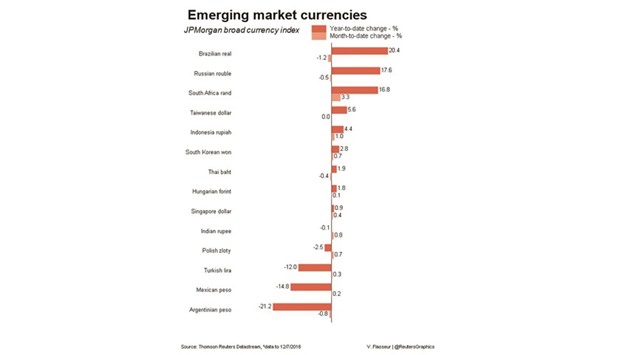

garaph