European stocks fell yesterday in nervy trade before Italy’s crunch referendum and Austria’s elections, amid fears that both could send shockwaves reverberating across markets.

London’s FTSE 100 was 0.3% down at 6,730.72 points, Frankfurt’s Dax 30 slipped 0.2% down at 10,513.35 points, Paris’ Cac 40 ended 0.7% down at 4,528.82 points and Milan’s FTSE MIB dipped 0.07% down at 17,087 points at close yesterday. The Euro Stoxx 50 ended 0.3% down at 3,020.93 points.

“European equities finished the week on a downbeat note, with most major indices ending both the day and the week lower,” said market analyst Jasper Lawler at CMC Markets.

“Rising political risk in Europe is seeing funds flow to the US where companies potentially stand to benefit from lower taxes and regulation under Donald Trump,” he added.

In New York, US stocks were mostly higher after data showed the US unemployment rate dropped in November to its lowest level since August 2007, all but guaranteeing an interest rate hike by the Federal Reserve later this month.

The jobless rate fell three-tenths of a percentage point to 4.6%, with a solid 178,000 net new positions created, in line with analysts’ expectations.

Despite an interest rate hike being positive for the dollar, it was down against the euro, yen and pound in late European trading, which analysts put down to the markets having already priced in a December move by the Fed.

But analyst Ipek Ozkardeskaya at London Capital Group warned that “the outcome of the (Italian) referendum could have a significant impact on the short-term euro volatility”.

The expected rejection by voters of the referendum “could lead to PM Renzi’s resignation and turbulence in the markets at the political upheaval,” said XTB analyst David Cheetham.

However, trader Markus Huber at City of London Markets told AFP that “even if the No vote in Italy wins and Austria will get a far right president, any jitters this might cause for the markets should be short lived”.

He pointed out the ECB has pledged to stand behind Italy if there were liquidity problems and that an increase to US growth from the economic policies of incoming US president Donald Trump was more important.

“A booming USA will help the entire global economy and the eurozone therefore (will be) much less prone to any crisis as investors won’t lose faith and keep investing,” said Huber.

Oil prices drifted higher yesterday, but were up considerably over the week due to Opec’s decision Wednesday to cut oil production.

Brent soared over 13% over the week.

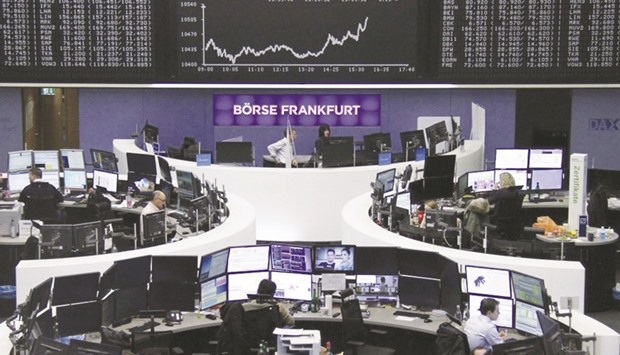

Traders work at their desks in front of the DAX board inside the Frankfurt Stock Exchange yesterday. The Dax 30 index slipped 0.2% down at 10,513.35 points at close.