Emerging market equities rose more than 1% to 11-day highs yesterday, helped by a broad commodity and equity rally and a pause in the rise of US bond yields and the dollar.

Expectations of inflation stemming from President-elect Donald Trump’s future fiscal policies have fed through to US bond yields and pushed the dollar to near 14-year highs.

That in turn has weighed heavily on emerging markets. But with 10-year bond yields some 10 basis points off highs hit earlier in the week, there was some relief for riskier assets.

At the same time, Trump’s plans to boost infrastructure and defence spending are lifting commodity prices, helping producers.

“This morning we are seeing a bit of a relief, emerging markets are recouping some of the losses seen after the US election,” said Guillaume Tresca, senior emerging markets strategist at Credit Agricole. “Risk appetite is improving as equity markets are up but the biggest factor is a decline in the long-term (US) rates.”

MSCI’s benchmark emerging stocks index posted its biggest one-day gain since before the November 8 US election.

Commodity producers made some of the biggest advances, after copper rose 2% to one-week highs and palladium hit its strongest in over three months.

Oil prices also surged to three-week highs on growing conviction that major producers, including Russia, will reach a deal on output. South African shares rose 1.2% to 10-day highs and Russian dollar-denominated stocks climbed around 1%.

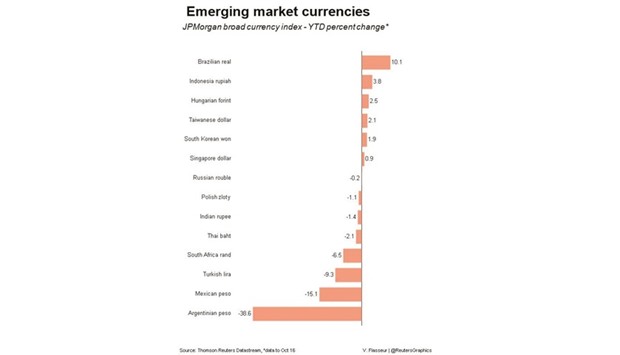

Their currencies also gained, with the Russian rouble firming 0.7% against the dollar, the Kazakh tenge up 1% to three-week highs and the South African rand firming 1.3%. Although Trump reiterated his intention to withdraw from the Trans-Pacific Partnership (TPP), an Asia-Pacific free trade accord, this failed to dent enthusiasm for Asian equities, with Hong Kong stocks up 1.4% and Chinese mainland shares up just under 1% to 10-month highs.

Emerging Europe also made strong gains, with Polish stocks rising 1.2% and Czech shares up 0.6%. With the dollar index slipping 0.3%, even non-commodity related currencies were able to make gains.

The Chinese yuan rebounded from the near 8-1/2 year low hit on Monday after the central bank set a higher official fix for the first time in nearly three weeks.

The Mexican peso, which has borne the brunt of selling in the wake of Trump’s victory given his campaign rhetoric on trade tariffs, immigration and border walls, strengthened as much as 0.8%.

Even the Turkish lira, which has been pounded in recent days as a crackdown in the wake of July’s failed coup continues, gained 0.2%. Economists are divided over the possibility of a lira-supportive rate rise at the central bank’s Thursday meeting, with almost half of those surveyed by Reuters predicting a 25 basis point rise in one-week repo rates to 7.75%.

EME