Aruna Desai has a problem with the thousands of Indian rupees she has with her in the US – she can’t find a bank to exchange her funds and couldn’t give the money away if she tried.

Since Indian Prime Minister Narendra Modi removed 500- and 1,000-rupee notes from circulation, currency exchange providers in the US have been unable to take the outlawed bills. Some of the country’s biggest banks, including JPMorgan Chase & Co and Citigroup Inc, work with vendors to provide rupees to clients and those vendors have made the bills unavailable, spokesmen for the banks said. Wells Fargo & Co also said it can’t supply rupees at this time, while Bank of America Corp said it has never accepted the currency for exchange.

“If you have a euro, you can go to a bank and exchange it,” Desai, 76, of Cliffside Park, New Jersey, said in a telephone interview. “For an Indian rupee, I don’t think there’s any bank that does that here.”

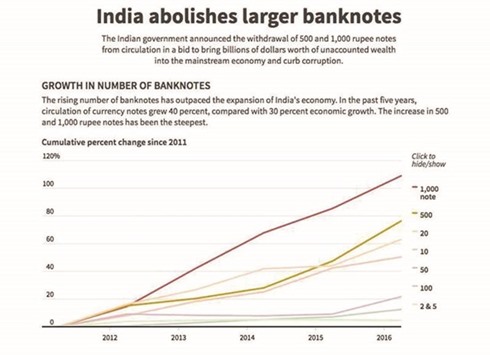

Five-hundred rupee ($7.34) and 1,000-rupee notes ceased to be legal tender on November 9, Modi said last week in a surprise announcement, sweeping away 86% of the total currency in circulation. The move has been seen as an attempt to fulfill his election promise of curbing tax evasion and recovering illegal income, locally known as black money, stashed overseas. The notes will have to be deposited in banks by the end of December, Modi said.

“For our clients, it’s very hard,” Nandita Chandra, head of Great Indian Travel Co’s New York office, said in a telephone interview while visiting New Delhi. “A lot of people are affected and we don’t have a culture that is credit-card friendly, it’s a cash-based economy.”

Mastercard Inc, the second-largest payment network, heralded the move as one that will reduce crime and drive growth in the Indian economy.

Modi’s “bold action and leadership is a critical step in positioning India to be a leader in the global cashless and digital economy movement,” Porush Singh, the firm’s president for South Asia, said in a statement. “Mastercard is committed to working with the government to provide the cashless solutions that combat corruption and create growth, and inclusion for all members of society.”

Travelex Ltd, which operates more than 200 currency exchange stores in the US, said it’s unable to accept the 500- and 1,000-rupee bills from customers because it can’t repatriate the cash in bulk under India’s current rules, said Lucie Smith, a spokeswoman for the London-based company. Western Union Co, the world’s largest money-transfer service, said for those locations facing a shortage of rupees, customers are able to receive checks or remittances to their bank accounts.

“A lot of people are trying to give money to their friends to spend it, or else it will go to waste,” said Desai, who makes a yearly trip to India to work at a medical camp. If she can’t find a place to exchange or use the bills, she’ll “just have to throw it away.”

.