Iran’s crude oil exports are set to fall 7.5% in November to a four-month low, a source with knowledge of its preliminary tanker schedule said, as low seasonal demand in Europe takes the edge off its post-sanctions export bonanza.

Iran’s oil exports typically hit a low around October or November each year, reflecting peak refinery maintenance seasons in Europe and

in Asia.

Overall, Opec’s third-largest producer has been regaining market share at a faster pace than analysts had projected since sanctions were lifted in January, with its exports of crude and condensate hitting a five-year high of at least 2.60mn barrels per day (bpd) in September.

Iran’s sales of crude and ultra light oil condensate are set to fall for a second straight month to 2.37mn bpd in November from 2.56mn bdp in October, according to the source who is familiar with Iran’s export

situation.

Compared with a year ago, Tehran’s November crude exports are set to rise 118%, according to the source.

Iran’s current oil output is almost 4mn bpd, and its exports have reached 2.4mn bpd, the managing director of the National Iranian Oil Company was quoted as saying by the oil ministry’s news agency last week.

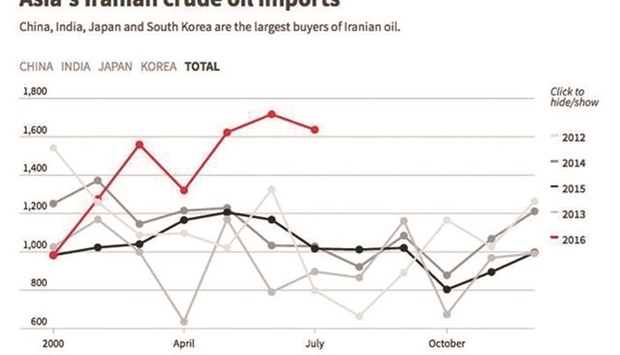

Iran’s crude and condensate exports to Asia this month are likely to total 1.93mn bpd, up nearly 100,000 bpd from October, but exports to Europe look set to fall to 433,000 bpd from 613,000 bpd in October.

Usually, the United Arab Emirates loads around 50,000 bpd to 145,000 bpd of Iranian condensate each month, but there are no loadings for the Middle East this month, the first time in at least two years.

Loadings headed for China will jump 35% from October to 669,000 bpd. But India will load slightly more at 674,000 bpd, retaining its status as Iranian oil’s top buyer for the second straight month.

South Korea is set to take 368,000 bpd in November, down from 379,000 bpd in October.

Japan is lifting 156,000 bpd of crude, down 31%.

Taiwan, which has been buying from Iran every other month, will lift about 2mn barrels in

November.

Turkey is lifting 133,000 bpd in November, down 31% from the previous month. Greece is lifting around 2mn barrels, and Spain and Italy are loading about 1mn barrels each.

Iran is also pushing about 2mn barrels of crude into its offshore storage this month, the source said.

IRAN