As part of Turkish President Recep Tayyip Erdogan’s concept of strengthening the religious pillars in society, Turkey embarked on a drive to expand the scope and customer base of Islamic finance in the country.

Currently, Islamic finance – or participation banking, as interest-free banking is called in Turkey – has a 5%-market share in a country of 75mn people of which 97.8% identify as being Muslim. According to Turkey’s Deputy Prime Minister Mehmet Simsek, a target has been set to increase this market share to up to 15% by 2025.

“The Islamic finance sector is projected to grow to $3.5tn in assets over the next five years globally, and Turkey aims to manage a sizeable portion of this in the future,” Simsek said on October 28 at a conference in southern Turkey.

“We would like to turn Turkey into a hub of Islamic finance,” he said, adding that both state and private banks needed to develop their services in this area.

According to Simsek, the size of assets of Islamic banks in Turkey had reached around $39bn by the end of 2015. By tripling this amount to 15%, Turkey Islamic finance asset would reach $117bn by 2025, overall sector growth not included.

Islamic banking is not a new concept in Turkey, though. Shariah-compliant lenders have been operating for over 30 years in Turkey on a cooperative basis. In 2005, the Turkish government officially recognized them and offered state guarantees on capital deposited in these banks. Currently, six banks, two of which are state-owned, have a licence to provide Islamic finance services. Privately owned Islamic banks are Bank Aysa and Türkiye Finans, while Albaraka Türk and Kuvyet Türk are Turkish branches of foreign Islamic banks.

In May 2015, the government established Turkey’s first ever public-run Islamic bank as an Islamic window of state bank Ziraat Bankasi. In February this year, state-run Vakifbank also introduced an Islamic unit. These banks presently operate 965 branches across the country and employ more than 16,000 staff, according to data from the Participation Banks Association of Turkey. The association also found that total assets of Turkish Islamic lenders grew by 15.3% in 2015 (of five banks back then) over the previous year to reach $38.7bn. Simsek noted that the government intends to take on a leading role to boost Islamic banking. More branches of Islamic banks would be opened in small towns to reach out to new customers and another state-owned bank, Halkbank, could open an Islamic window at a later point of time as soon as it gets clearance from the regulator.

Simsek also said that the issuance of US dollar- or Turkish lira-denominated sukuk by the Undersecretary of Treasury was underway. Sukuk, in particular, was “an important tool of our portfolio in efforts to diversify debt instruments and the expansion of our country’s investor base,” Simsek noted, adding that China – through Beijing’s New Silk Road project – was interested to use Islamic finance to provide an alternative resource for infrastructure investments and to strengthen its ties to Muslim countries in the Middle East and West Asia.

The overall growth potential of Islamic banking in Turkey is seen as strong with millions of Muslims looking for alternatives to conventional banking products.

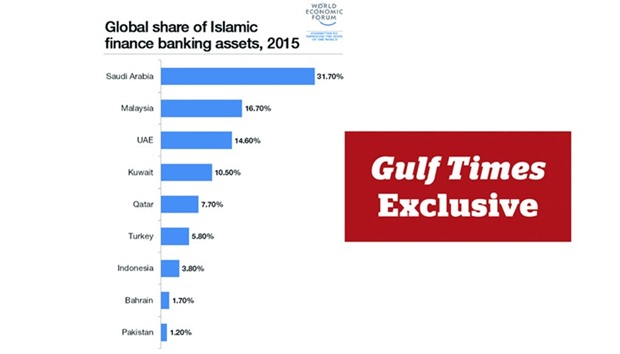

The World Economic Forum puts Turkey sixth in the list of countries with the largest Islamic finance market share globally, at 5.8% and just behind Qatar with 7.7%. A report by S&P Global Rating released in June 2016 and entitled “The Emergence of New Turkish Islamic Lenders: A Game Changer?” says that growth rate of Islamic banking is expected to exceed that of conventional lenders in Turkey, and the market share of Islamic banks in the country was set to double to more than 10% by year-end 2025, coming close to the government’s target.

In comparison, it took the sector ten years to double the market share to the current 5% from 2.5% in 2005.

Over the past couple of years, Turkey had the fourth-fastest growth rate of an average of 19% annually in Islamic finance worldwide behind Indonesia, Pakistan and Qatar, on par with Malaysia and ahead of Saudi Arabia, UAE, Kuwait and Bahrain, data of consultancy EY shows.