New Development Bank, formed by five of the world’s biggest emerging markets, plans to sell as much as $500mn worth of offshore rupee bonds next year as the youngest multilateral lender looks to expand its reach.

“We look forward to raising money in most of our member country markets including India through a masala bond issue which could be $250mn-$500mn,” NDB president KV Kamath said in an interview on the sidelines of the Brics summit in Goa, India. “The Indian issue probably will be in the first quarter of next year.”

The NDB, which began lending this year, was floated as an alternative to the Asian Development Bank and World Bank by the leaders of Brazil, Russia, India, China and South Africa. It’s looking to double its capital base to $100bn in the coming years. While lending in 2016 will be as much as $1.5bn, the NDB may offer an additional $2.5bn next year, Kamath said. It will also look to extend credit to the transport sector while continuing loans to fund green energy, he said.

The market for masala bonds is picking up from a slow start after the Reserve Bank of India last year allowed domestic companies to issue offshore rupee debt to reduce dependence on foreign currencies including the US dollar. Housing Development Finance Corp, India’s biggest mortgage lender, was the first issuer to sell masala securities in July and the Canadian province of British Columbia became the first government to issue the notes.

Meanwhile, the Brics Business Council, which met during the ongoing 8th annual summit, suggested the member countries continue the dialogue for a new rating agency for emerging economies. “Among key recommendations of various working groups of Brazil, Russia, India, China, South Africa Business Council is the continued dialogue on Brics rating agency,” Onkar Kanwar, chairman, Brics Business Council - India Chapter, said during the meet.

With a huge scope for intra-Brics cooperation in infrastructure development and financing, the formation of a group of angel investors was also one of the key recommendations of the Council, he said.

The Council said they looked upon the New Development Bank for developing an infrastructure project preparation facility and for a deep and vibrant capital market.

With the expansion of the Brics agenda, the Council also emphasised on the need to enhance business cooperation in agriculture by way of sharing of best practices among members.

Vikramjit Singh Sahney, chairman, Sun International, suggested the Council to do one flagship project in all of these suggested sectors.

The need to have investment facilitation agreements among the members was emphasisd by Jose Rubens de La Rosa from the Brazil Chapter, while Xie Biao from the China Chapter said that if they consider Brics as one economic community, they consider a very rich economic development potential.

South Africa emphasised that the country should be considered as a platform for the rest of Africa.

Looking to promote a vibrant environment for business through Brics Business Council, China’s Capt Xu Lirong said consensus on a number of issues was forged during the meeting.

The Brics Business Council based on the recommendations and viewpoints in the meeting will present its annual report to the heads of the member countries on Sunday, Kanwar said.

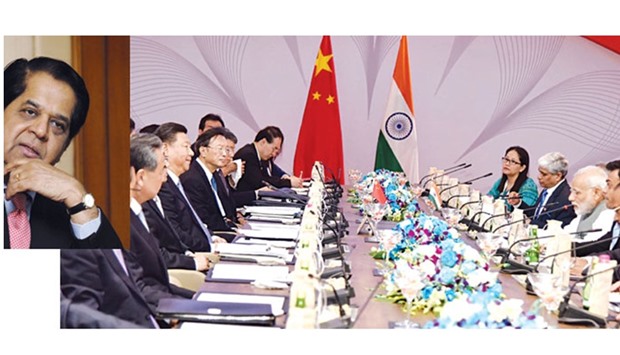

Kamath: We look forward to raising money in most of our member country markets including India. Indian Prime Minister Narendra Modi and Chinese President Xi Jinping at the bilateral talks before the Brics summit in Goa, India yesterday.