Natural gas has a lot going for it. It burns cleaner than other fossil fuels, producing about half the carbon dioxide of coal. Thanks to new discoveries and the US shale boom, it’s cheap and plentiful. But there’s a catch: Gas is tricky to transport from the often-remote fields where it’s found to where it’s needed. In many places, pipelines simply aren’t practical.

The solution? Turn the gas into a liquid by super-cooling it to minus 162 degrees Celsius (minus 260 degrees Fahrenheit). Liquefied natural gas, known as LNG, can be loaded on ships and transported around the world. This high-tech process has transformed natural gas into a more freely traded commodity with the potential to reshape the politics of global energy. Is LNG the fuel of the future?

The Situation

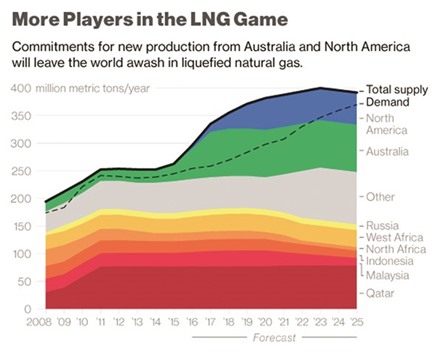

The global trade in LNG has become easier with the June expansion of the Panama Canal, which can accommodate most of the world’s tanker fleet for the first time. A slew of LNG plants in Australia and the US are coming online over the next few years, as investments made in an era of higher energy prices reach completion. Global LNG production is forecast to expand by about 50% by the end of the decade, adding to a market that’s already oversupplied. That’s sent the spot LNG price in Asia tumbling as much as 80% from a record in 2014, prompting delays and cancellations of new plants.

At the same time, demand for LNG is faltering as Japan restarts its nuclear reactors and China’s economic growth slows. The fuel is also competing with cheaper coal and renewables. Even so, more countries are trading in LNG, with 34 nations importing it and 19 exporting it by the end of 2014. Jordan, Egypt and Pakistan are turning to LNG to fuel electricity generation as prices fall and import terminals become less expensive to build. The gas is also used to power ships and trucks. In Europe, shifting to LNG is critical for countries such as Lithuania and Poland that are looking to escape the pipeline politics of buying gas from Russia. LNG is also offsetting dwindling gas output from the North Sea.

The Background

Commercial LNG shipments began in 1964 with regular cargoes from Algeria to the UK and France. The global fleet now includes more than 400 vessels, the biggest as long as almost four American football fields. LNG is a capital-intensive business: Tankers cost about $250mn, and building a terminal for import or export is a multibillion-dollar undertaking. Qatar is the world’s biggest producer of LNG, with about three-quarters of the fuel sold to energy-poor Asian countries such as Japan and Korea. Natural gas supplies about a fifth of world energy, and its use is growing. Only about 10% of that currently comes in the form of LNG, though it accounts for half of new gas capacity.

More projects are being considered to ship gas from large fields in Mozambique and Iran. The biggest turnaround has come in the US, where hydraulic fracturing, or fracking, has transformed the country from an importer to an exporter of natural gas. It has also made LNG easier to trade: While Asian cargoes have traditionally been sold under long-term contracts with limits on where vessels can be sent, US shipments are free of such restrictions.

The Argument

More nations have shifted to LNG as a way to reduce greenhouse gas emissions. Demand for the fuel will be driven by how quickly countries turn to gas in a bid to displace coal as the largest source of power generation. Big oil companies have pushed into LNG as a way to embrace cleaner energy and tap new markets. Shell’s $53bn acquisition of BG Group this year — the industry’s biggest deal in a decade — included a fleet of tankers and made the Dutch giant the world’s largest LNG trader. Still, enthusiasm for LNG isn’t universal. The American Public Gas Association, an organisation of municipal-owned natural gas utilities, opposes large-scale US exports because sending gas overseas could raise prices for consumers at home. What’s more, the supply glut means that more than half of the 38 LNG terminals proposed in the US by 2015 will likely never be built.