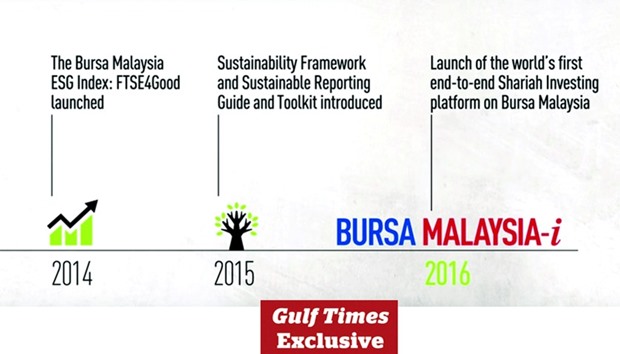

Malaysia, the world’s dominant Islamic finance destination, fostered its role as a key player in the industry by opening the world’s first end-to-end Islamic exchange platform earlier this September at Kuala Lumpur’s stock exchange, Bursa Malaysia.

The new platform, called “Bursa Malaysia-i”, offers investors the opportunity of investing in and trading of Shariah-compliant products via a Shariah-compliant platform and incorporates the full range of stock exchange-related services including listing, trading, clearing, settlement and depository facilities. It is geared at both domestic and foreign investors, not only Islamic investors but also conventional investors looking for ethical alternatives when putting their money to work.

“The purpose of introducing this new service is to provide a conducive marketplace for Shariah-compliant investing and to help further strengthen the products and services offered by the Islamic capital market. In doing so, we hope to position Malaysia as the pre-eminent marketplace for Islamic based financial offerings and Shariah investing,” said Bursa Malaysia CEO Tajuddin Atan at the launch.

Currently, around 1.1tn ringgits ($266bn) or around two thirds of the total market capitalisation of Bursa Malaysia of 1.6tn ringgits ($387bn) are related to Shariah-compliant investment products as of this July, which makes Malaysia the global leader in the Islamic capital market. Products include i-Stocks (short for Islamic or Shariah-compliant stocks), which comprise 73% or 669 of all stocks listed on Bursa Malaysia; i-Indices (Shariah-compliant indices); i-ETFs (Shariah-compliant exchange traded funds), i-REITs (Shariah-compliant Real Estate Investment Trusts) and exchange traded sukuk.

Altogether, the market capitalisation of the exchange has been growing at a tremendous pace of 363% since 1997. Bursa Malaysia’s sukuk market makes up more than 50% of the global sukuk outstanding for the past 16 years.

“The shift towards ethical or value-based investing continues to grow,” said Bursa Malaysia’s Chairman Amirsham Abdul Aziz at the launch event. “This shift also appears to track the increasing demand for Shariah-compliant financial solutions and a growing appetite for Islamic capital market products and services. It is a pattern that is observed globally and is indeed evident in Malaysia, particularly the demand for Shariah investing at both retail and institutional levels. Bursa Malaysia-i will cater to the faith-based investors or those seeking ethical investments,” he added.

He also emphasised that the new Islamic stockbroking platform was “just the beginning of a new phase” in the development of Malaysia’s Islamic capital market, noting that Bursa Malaysia would continue to develop cross-border capital flow and market accessibility to Malaysia by providing the respective infrastructure. Plans are to grant direct market access for foreign investors beyond inter-broking services and across global time zones, as well as mutual recognition by market regulators.

The exchange will also develop Shariah-compliant tools that support foreign investors to hedge their exposure to the Malaysian ringgit more effectively, and will also enable the trading of US dollar-ringgit futures to reduce currency risks for investors from abroad.

As for Bursa Malaysia-i, investors can so far choose to use the new end-to-end Shariah-compliant investment facility via nine Shariah-compliant financial institutions in Malaysia – AmInvestment Bank, Affin Hwang Capital, BIMB Securities, CIMB Securities, Jupiter Online, Kenanga Investment Bank, RHB Investment Bank, Malacca Securities and Maybank Investment Bank – or their affiliate banks abroad. For the future, Bursa Malaysia said it is encouraging its financial intermediaries to increase connectivity between global financial centres to allow “meaningful participation” of global financial players in the Malaysian market, starting with improved linkages within the Association of Southeast Asian Nations, or Asean, as well as with the Gulf Cooperation Council area where sizeable amounts of money could be tapped for the Islamic finance and wealth management industry in Malaysia.

Bursa Malaysia’s latest launch: The world’s first integrated end-to-end Islamic trading platform, meant to ease procedures for Islamic investors and lure foreign capital into the country’s huge Shariah-compliant finance market.