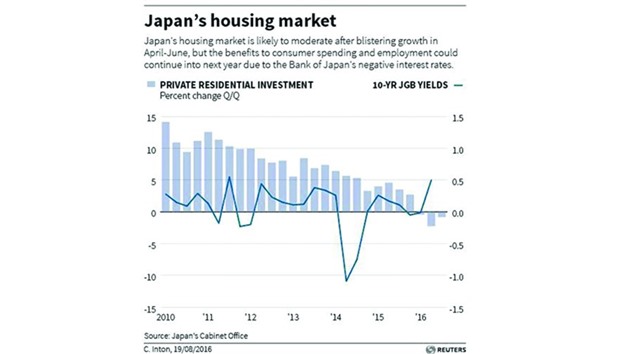

Japan’s housing market is likely to moderate after investment grew at its fastest in five years in April-June, but the benefits to consumer spending and employment could continue into next year due to the Bank of Japan’s negative interest rates.

While the BoJ courted controversy by pushing rates below zero this year, putting banks offside in particular, the policy has proven a hit with first-time home buyers and homeowners looking to refinance mortgages.

And rises in long-depressed property prices are causing some people to buy sooner rather than later, which should lift demand for durable goods such as appliances and furniture – just the recipe to break Japan’s deflationary

mentality.

“Our furniture sales have been doing well,” said Mariko Ooguri, a spokeswoman at retailer Ryohin Keikaku Co, which includes the Muji chain of stores and is expecting a 10% rise in operating profit in the year to February.

“The housing market is one of the reasons why, but we have spent many years improving training for our furniture sales staff.

We feel there is more room for growth in furniture.”

Private residential investment jumped 5% in April-June, Cabinet Office data showed last week.

It was some rare good news in a gross domestic product report showing the economy ground to a halt due to weak exports and capital expenditure.

“The housing market can continue to grow for a while as long as the current low interest rate environment remains,” said Hiroshi Miyazaki, senior economist at Mitsubishi UFJ Morgan Stanley Securities. “This is a bright sign that Japan is moving away from deflation.”

While Japan cannot rely solely on housing investment for growth, related spending on durable goods should lend support to overall consumption.

Mortgage refinancing at lower rates also leaves households with more disposable income.

Bank of Tokyo-Mitsubishi UFJ, a unit of Japan’s largest lender, has cut its prime lending rate for a 10-year fixed-rate mortgage to a record low of 0.5%, and says refinancing applications are about three times higher this year. Mizuho Bank, its main rival, is charging 0.65%, and Sumitomo Mitsui Bank has 0.7%.

Both report strong rises in refinancing applications.

Residential property prices have been rising for the past three years, not just in the three major cities but also in some second-tier cities, which economists expect to lure first-time buyers worried about having to pay more later.

Outstanding mortgage lending by domestic banks rose to ¥119tn ($1.2tn) in the January-March quarter, according to the Japan Housing Finance Agency, the highest since the government-backed home lender began tracking data in 1989.

“Negative rates won’t change, and this is a structural factor that will support the housing market,” said Takuya Hoshino, economist at Dai-Ichi Life Research

Institute.

“Related industries will benefit, such as construction, retail and home electronics.”

In the April-June quarter, household consumption rose just 0.1%, but would have been flat excluding spending on durable goods.

But while the sector is a bright spot, it is not expected to maintain its recent pace.

New construction of condominiums in Tokyo, Nagoya and Osaka fell 16.3 in June from a year earlier, following a 14.8% decline in May.

Rising residential vacancies in some areas and a rising stock of unsold apartments also show momentum is slowing.

“Loans for apartments are rising, but vacancy rates are too, so I’m a little worried,” said Yusuke Ichikawa, senior economist at Mizuho Research Institute.

“The market cannot continue to expand in July-September at the same pace it did in April-June.”