European stock markets stirred yesterday at the end of a tranquil week as Federal Reserve chief Janet Yellen indicated there was a case for raising US interest rates.

European stocks advanced marginally as London’s FTSE 100 was up 0.3% at 6,838.5 points, Frankfurt’s DAX 30 was up 0.5% at 10,587.8 points, Paris’ CAC 40 was up 0.8% at 4,441.9 points and Euro Stoxx 50 was up 0.9% at 3,013.0 points at close.

Market watchers had been waiting for Yellen to show her hand in an address to an annual gathering of central bankers in Jackson Hole, Wyoming.

Noting strong US job growth, Yellen said gradual increases in the Fed’s benchmark rate in the coming years should be expected.

“In light of the continued solid performance of the labour market and our outlook for economic activity and inflation, I believe the case for an increase in the federal funds rate has strengthened in recent months,” Yellen said, according to prepared remarks which traders appeared to see as a mix of hawkish and dovish.

Fed watchers had complained this year that US central bankers’ public pronouncements had been inscrutable and sometimes contradictory, leaving investors perplexed.

Her remarks raised the likelihood that the Fed will increase the rate from its current ultra-low 0.25-0.50% level by the end of the year, and as early as its next meeting in September.

“Our view is that most officials will want to see more concrete evidence of a rebound in GDP growth and a rise in inflation towards the 2% target, with a December move still appearing the most likely outcome” for a rate rise, Capital Economics ventured.

After a small initial rise on Wall Street in the slipstream of Yellen’s comments, the Dow Jones Industrial Average drifted, losing 0.4% mid-session, while the tech-heavy Nasdaq and the broad-based S&P 500 indices also reversed early gains.

Prior to Yellen’s comments being released Craig Erlam, analyst at Oanda trading group, indicated investors above all wanted “clarity on the near-term path of interest rates.”

Thereafter, he added her views “didn’t necessarily offer much in the way of surprises but it did confirm one thing — there is now a clear and public hawkish consensus building within the Fed and Chair Yellen is on board” with regard to guidance on monetary policy.

Speculation has grown that the bank could lift interest rates as early as next month, although most experts say that is unlikely and that December or February would be safer bets.

With an interest rate hike unlikely in the immediate future, the dollar was struggling to gain traction.

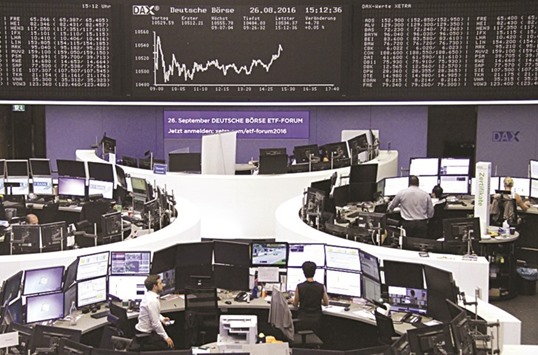

Traders work at their desks in front of the DAX board at the Frankfurt Stock Exchange. The DAX 30 index closed up 0.5% at 10,587.8 points yesterday.