Emerging markets fell to the lowest levels in more than two weeks as political and security concerns resurfaced in South Africa and Turkey, sapping appetite for riskier assets before a much-anticipated address by Federal Reserve Chair Janet Yellen.

The rand extended losses and government bonds slid the most since December after a news website said Finance Minister Pravin Gordhan had been summoned to report to police, raising concern he may be replaced. Stocks in Istanbul suffered the deepest drop in a month as Turkey launched its biggest military operation yet in Syria. South Korea’s won led retreats in Asian currencies after North Korea launched a ballistic missile from a submarine.

The flare-ups exposed the fragility of the emerging-market rally spurred in large part by investors seeking refuge from low or negative rates in advanced countries. Compounding the risks are growing wagers that the Fed will resume interest-rate hikes this year that would diminish the allure of higher-yielding assets. Traders are waiting to see if Yellen touches on how aggressive US monetary tightening will be when she addresses a gathering of central bankers on Friday.

“The big moves happening in Turkey and South Africa are a reminder that political risk is quite big in emerging markets,” said William Jackson, a London-based economist at Capital Economics Ltd “While political risks do matter, now it is all eyes on the Fed and Yellen.

The rally seems to have lost a bit of steam as investors wait to see what Yellen will say. But it doesn’t look like there has been a dumping of the assets.”

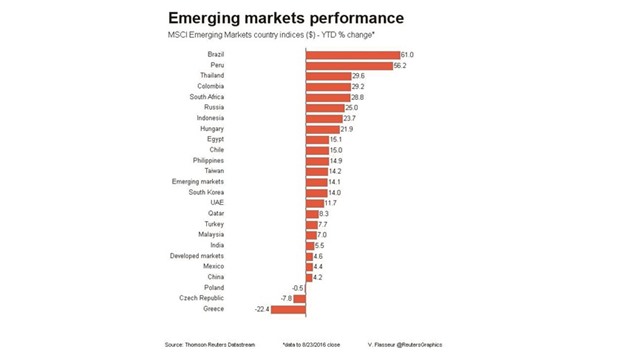

The MSCI Emerging Markets Index lost 1%, the most on a closing basis since July 6, to 897.17 in London. A gauge tracking financial stocks led losses in all 10 industry groups as markets from Turkey to Dubai slid at least 1.5%. The Borsa Istanbul 100 Index suffered its biggest slide since a selloff on July 21 that happened as Turkey entered a state of emergency in the wake of a failed coup attempt.

While the FTSE/JSE Africa All Shares Index in Johannesburg advanced, a gauge of banking shares slumped 7.7%, the most since December 10 on a closing basis.

Dubai’s DFM General Index retreated for a fourth day and the Micex Index ended a two-day advance in Moscow. Brent crude fell 1.3%, trading below $50 a barrel for the third day.

The Hang Seng China Enterprises Index of mainland stocks listed in Hong Kong fell 0.8%, as Industrial and Commercial Bank of China decreased 2% and China Construction Bank Corp dropped 0.9%.

The MSCI Emerging Markets Currency Index fell 0.8%, poised for its biggest loss since June 24.

The won weakened 0.6% against the dollar. North Korea test-fired the missile early yesterday, adding to the mounting geopolitical tension in the region since South Korea said it would deploy a new Thaad missile shield system. The rand, which slid 3% on Tuesday, lost 1% to 14.1404 per dollar. It’s fallen for four days straight, diminishing the appeal of the best carry trade in emerging markets this quarter. The naira dropped 4% as Nigeria’s central bank governor said non-performing loans pose a threat to the financial system.

Yields on South African local-currency debt due December 2026 increased 47 basis points to 8.99%, the biggest move since Zuma roiled markets in December by firing then-Finance Minister Nhlanhla Nene and replacing him with a little-known lawmaker.

In Turkey, the government’s 10-year bond yield climbed five basis points to 9.84%. The premium investors demand to own emerging-market debt over US Treasuries was little changed at 334 basis points, according to JPMorgan Chase & Co indexes.

Global bond funds have become more exposed to fluctuations in emerging debt markets amid a hunt for yield in recent months.

.