Middle East carriers have registered an 11.8% rise in demand in the passenger market in May compared to a year ago, which was the “largest increase” among various regions in the world, IATA said in a report.

Capacity increased 15.6%, however, and load factor dropped 2.4 percentage points to 71.9%. Growth in capacity has now exceeded traffic growth in 18 of the past 20 months, IATA said in its passenger traffic report released yesterday.

All segment-based passenger routes to and from the Middle East led by the three big Gulf carriers — Qatar Airways, Emirates and Etihad — saw “solid gains” during the first five months of 2016, IATA said.

However, there remains little sign of any easing in the upward trend in passenger capacity; annual growth in Middle Eastern international revenue passenger kilometres (RPKs) has now lagged behind that of capacity for 18 of the past 20 months.

IATA data showed that the global demand (measured in revenue passenger kilometres, or RPKs) rose 4.6%, compared to the same month in 2015, which was the same level achieved in April. Capacity climbed 5.5%, which pushed the average load factor down 0.7 percentage points to 78.7%. Demand for domestic traffic rose 5.1%, outpacing international demand growth of 4.3%.

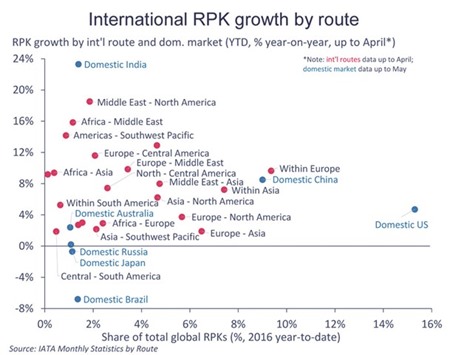

The global air passenger market has made a robust start to 2016 so far. Admittedly, the 6.0% year-on-year increase in industry-wide revenue passenger kilometres (RPKs) in the first five months of 2016 has been flattered by the leap year.

But even after correcting for the extra day in February, IATA estimates that traffic still grew by 5.3% this year to date – in line with the average pace seen over the past decade.

Nonetheless, following a bumper year in 2015, there are ongoing signs that passenger growth has shifted down a gear. Annual growth in RPKs remained unchanged at 4.6% in May — its slowest pace since January 2015.

This, IATA said can be attributed partly to the Brussels terrorist attacks, which affected the large international European market in April and May, but whose impact is expected to be only transitory in nature.

More significantly, the recent moderation in passenger growth reflects the ongoing fragile global economic backdrop. Heightened uncertainty post-‘Brexit’ only increases the downside risks from the latter.

All told, while seasonally-adjusted passenger volumes picked up in May, the upward trend in RPKs has eased since January; the market has grown at annualised rate of around 4% since the start of 2016.

Looking ahead, further stimulus is likely to come through in the form of lower fares from prior falls in oil prices. But this impact is likely to wane over the course of the year, IATA said.

Business / Business

Mideast sees ‘highest’ regional demand rise in passenger market in May, says IATA

.