Emerging market currencies and stocks drifted lower in Europe yesterday, having been lashed overnight by a renewed wave of Brexit anxiety, Chinese currency weakness and oil price falls.

The ugly mix pushed MSCI’s benchmark EM index down 1.2% for a second day running and left South Africa’s rand down 1% and Turkey’s lira, Mexico’s peso and Russia’s rouble all down 0.5%.

The prospect of what could be some dovish US Federal Reserve minutes later helped slow the selling in European trading though it couldn’t stem it completely.

Polish stocks and zloty, which have borne the brunt of the Brexit stress in emerging markets, dropped for a fifth and fourth day respectively to take the share losses since April to 15%.

Poland’s central bank is also meeting. It is widely expected to keep interest rates at 1.5%, but traders will be keen to hear what the new head of the bank, Adam Glapinski, thinks will be the impact of Brexit on the economy.

“We still think Poland’s next move could be a (interest rate) cut,” said Rabobank strategist Piotr Matys.”Probably not this year, but early next year when we will have a better picture on Brexit and the impact on the Polish economy.”

The general sense of global uncertainty saw the cost of insuring emerging market countries’ debt continue to creep up, even as global bond yields continued to slide.

A heavy drop in oil prices to back under $48 a barrel added pressure.

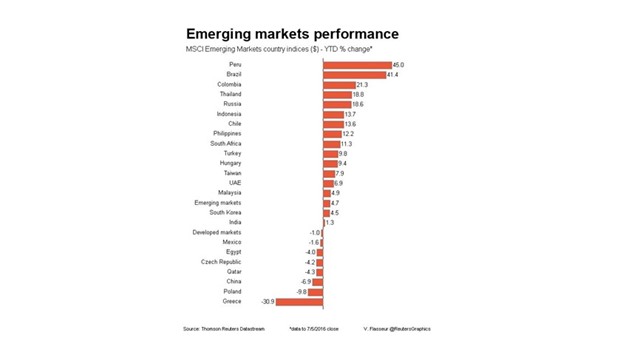

Russian stocks slid in line with the rouble after Latin American stocks, which have had a bumper 2016 so far, dropped 2.3% on Tuesday.

Questions also lurked over China’s intentions for its currency after the yuan fell for to a fifth consecutive session as the People’s Bank of China set its daily guidance rate at its lowest since November 2010.

State-run banks later sold the dollar, limiting the yuan’s fall, traders said though the moves continued to buffet other Asian currencies.

South Korea’s won and Taiwan’s dollar both touched one-week lows.

Many Southeast Asian currencies meanwhile were barely traded as local markets closed to celebrate the end of the Muslim fasting month.”

It is way too early to consider buying EM assets,” Rabobank’s Matys said of the onging selloff.”It is not over so I maintain my very cautious view.”