Oman, the largest Arab oil producer that’s not an Opec member, raised $2.5bn from its first international bond sale in almost two decades as it seeks to plug a budget deficit caused by crude’s decline.

The Gulf nation sold $1bn of five-year notes at a yield of 245 basis points over the benchmark midswap rate and $1.5bn of 10-year bonds at a spread of 320 basis points, according to a person familiar with the matter. Pricing was tightened from the initial guidance of mid to high 200 basis points for the five-year notes and mid-300 basis points for the 10-year bonds, said the person, asking not to be identified because the information is private.

Oman joins several other governments and companies from the six-nation Gulf Cooperation Council tapping the bond market as they fund shortfalls after the price of crude fell by about half over the past two years. The region is home to about a third of global oil reserves.

Qatar, the world’s biggest liquefied natural gas exporter, raised $9bn from a three-part bond sale last month in the Middle East’s biggest-ever issue, and Abu Dhabi raised $5bn in April.

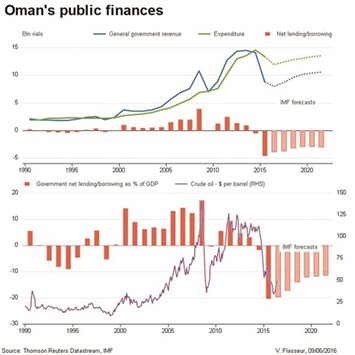

The budget deficit for Oman, the second-smallest economy in the GCC, is forecast at 19.7% of gross domestic product this year compared to 20.4% in 2015, according estimates from the International Monetary Fund. The country has the lowest investment-grade score from S&P Global Ratings after being cut two notches in February.

..