Owing to the sometimes complex structure of Shariah-compliant finance vehicles, offshore jurisdictions have become increasingly popular with Islamic finance institutions in the recent past. One reason is that such jurisdictions allow the hassle-free incorporation of trusts, special purpose vehicles or other financial intermediary bodies necessary to be established between parties within an Islamic finance structure, and another that offshore financial centres are usually offering services at lower costs in a favourable tax environment.

If chosen wisely, they provide state-of-the-art financial infrastructure, as well as a stable and strong regulatory framework, political stability, investor protection and business-friendly laws, adherence to international standards like anti-money laundering provisions, while at the same time upholding banking secrecy and anonymity.

The strong upswing in the global Islamic finance sector has naturally prompted some offshore financial centres to adapt their existing structures and their competitive niche expertise in the conventional financial market towards Shariah-compliant transactions. The most developed in this respect are, particularly, the Cayman Islands, Luxembourg and Labuan in Malaysia, as Kuala Lumpur-based International Islamic Finance Center pointed out in a recent research paper. Those three jurisdictions are accompanied by three Middle Eastern onshore financial centres that are remodelling offshore features in terms of regulations, costs and company registration, namely the Dubai International Financial Center, the Qatar Financial Center and Bahrain Financial Harbour.

All together, they are focusing on providing financial services for investments and structuring of Shariah-compliant finance vehicles, as well as on developing new Islamic financial products. Furthermore, other popular conventional offshore centres, such as the British Virgin Island, Bermuda or Jersey, are currently working on introducing facilities and services for Islamic finance to tap the this market. Understandable, since Islamic finance has meanwhile reached a global valuation with regards to its assets under management of close to $2tn.

Offshore financial centres can be utilised for a wide range of Shariah-compliant finance transactions and services. This includes offshore Islamic investment funds and private equity funds, endowment or charity (waqf) funds, sukuk and leasing vehicles, real estate and wealth management trusts, securitisation structures, as well as the implementation of special purpose vehicles that act as the above mentioned financial intermediaries or can be used for the registration of family and estate planning trusts or for registering company assets.

The big advantage is that offshore financial centres are able to offer significantly lower transactions and regulatory costs in comparison to those that arise from the structuring of Islamic financial transactions in an onshore environment and which can sometimes be substantial.

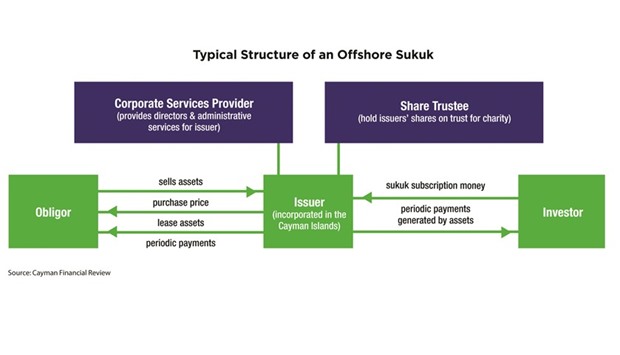

For example, the Cayman Islands are especially popular for special purpose companies as formal issuers of sukuk sold by large enterprises from the Middle East. Such a special purpose entity acts as an intermediary between the share trustee of the sukuk, normally the actual issuer, and a corporate service provider which takes over the administrative operations. Including other Islamic finance products such as Shariah-compliant funds, the market value of Cayman Islands-listed Islamic finance vehicles has reached a whopping $170bn.

Luxembourg, in turn, is well-known for its booming Islamic finance business with services such as Islamic private equity, Islamic real estate investment trusts, Islamic venture capital, Islamic wealth management services, takaful and sukuk. While the country, part of the European Union, is not exactly an offshore jurisdiction, it is known for the quasi-offshore tax treatment it offers for most categories of business. In terms of domiciling Islamic funds, it is the third-largest jurisdiction behind Malaysia and Saudi Arabia, with more than 100 funds incorporated, according to Thomson Reuters.

The Luxembourg Stock Exchange was the first European stock exchange to enter the sukuk market in 2002, and Islamic assets under management in the country are at a current value of $3.4bn.

Within Asia-Pacific, Malaysia’s International Business and Financial Center on the island of Labuan off the northern Borneo coast has developed into a regional hub for Islamic banking, Islamic capital markets, takaful, retakaful, Islamic funds, waqf and Islamic trusts, as well as for Islamic foundations. It attracts not only companies and investors from Muslim countries in the region, but increasingly from China and Australia, and its current Islamic assets under management are at a value of around $2bn.

ISLAMIC