Turkey’s lira headed yesterday for its biggest weekly fall versus the dollar in over a year, sharply underperforming other emerging assets, as chances of fresh elections raised fears for its credit ratings and economy.

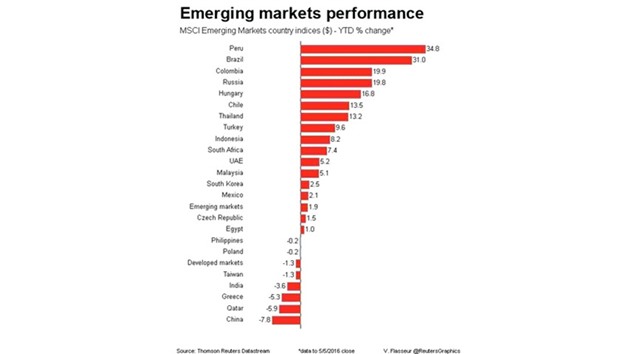

Heightened uncertainty around Turkey, caused by the exit of its moderate prime minister, comes amidst a weaker emerging markets backdrop, with MSCI’s emerging equity index falling for the sixth straight session.

The index, down 0.8% on the day, is on course to end the week down over 4%, its worst performance since early January due to fresh fears that central banks are powerless to lift global economic growth.

Turkey has experienced a turbulent week in which Prime Minister Ahmet Davutoglu stepped down, bowing to President Tayyip Erdogan’s drive to create an executive presidency and raising expectations that S&P will cut Turkey’s rating at least one notch deeper into junk later on Friday.

“The lira was always vulnerable to domestic or external shocks,” said Claire Dissaux, managing director for global economics and strategy at Millenium Global Investments.

“What matters to investors is economic policy. We had a market-friendly cabinet and a market-friendly new central bank governor and if that changes this could be another story for the Turkish lira, not just short-term volatility,” she said.

The Turkish lira slipped 0.2% and is set to end the week around 4.3% weaker against the dollar.

Istanbul stocks fell 0.9%, on course for their biggest weekly drop since June 2013, with losses of over 8%. Local 10-year bond yields remain at one-month highs.

Turkish five-year credit default swaps (CDS) were at 269 basis points (bps), hovering near a two-month high touched on Thursday having added around 30 basis points over the week, according to data from Markit.

Standard & Poor’s is thought likely to cut Turkey’s rating at least one notch later on Friday. However, fears are of future downgrades from Moody’s and Fitch, which rate Turkey investment grade.

JPMorgan, which runs the most widely used emerging debt indexes, advised cutting Turkish debt exposure citing the possibility of junk ratings from either of those two, which would cause significant investment outflows.

Earlier, Chinese mainland shares dropped over 2.6%, their biggest one-day fall in more than two months.

Hong Kong was also down 1.7%, Russian dollar-denominated stocks slipped 1.3% and South African stocks lost 0.7%.

The losses were partly attributed to weak commodity markets, with copper set for its largest weekly loss since early 2015, and a plunge in steel and ore prices.

Oil prices have also lost almost 7% this week, and are now back below $45 a barrel.

Commodity exporters’ currencies came under most pressure, with the Russian rouble and Kazakh tenge losing 0.5% and the South African rand down 0.3%.

Kazakhstan’s central bank cut its main policy rate to 15% from 17% on Thursday, citing easing pressure on the tenge and lower inflation risks.

The Polish zloty was the weakest performer amongst the Central and Eastern European currencies, slipping 0.5% against the euro ahead of a rate-setting meeting at which the central bank is expected to keep rates at 1.5%.