Economic growth in the eurozone will be steady but slow in the second quarter, surveys suggested yesterday, underlying European Commission concerns about the vulnerability of the currency bloc’s upturn.

Retail sales also fell across the eurozone as a whole in March, and a price indicator offered no succour to the European Central Bank in its struggle to stave off deflation.

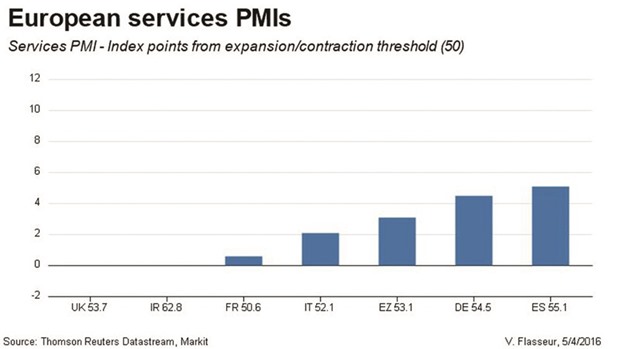

The final composite Purchasing Managers’ Index from Markit, which usually gives a good steer on overall economic growth, was at 53.0 last month, just below 53.1 in March. Both figures point to an expansion, but a not particularly dynamic one.

Although the bloc’s economy grew a faster-than-expected 0.6% on the quarter in the January to March period, blowing past both the US and Britain, that pace may not be sustained in the current quarter.

A Reuters poll last month predicted 0.4% growth in April-June as the region is still weighed down by high debt, weak bank profits, high unemployment and still considerable excess capacity in the economy.

The Commission, meanwhile, said in its economic forecasts on Tuesday that eurozone growth would be slower than previously thought, with subdued inflation this year, and warned of high external and internal risks to the bloc’s economy. “Clearly the PMIs, as they have been for a while, suggest that the strength we saw in Q1 might well be a temporary phenomenon. April’s figures are consistent with that view,” said Ben May at Oxford Economics.

Activity in the bloc’s dominant services industry also remained muted. The services PMI held steady at March’s 14-month low of 53.1 in April, just shy of a preliminary 53.2 reading.

Retail sales across the continent painted a similar picture for March, falling 0.5% on the month, compared with expectations of a more modest 0.1% fall, as consumers cut purchases of food, drinks and tobacco, the EU’s statistics office said.

“The March retail sales data are a warning sign that this is unlikely to be the start of a more robust recovery in the eurozone,” said Bert Colijn at ING. “While growth has been strong in the first quarter, it seems unlikely that current growth rates will continue to prevail in 2016.”

The European Central Bank surprised many in March with a volley of interest rate cuts, additional monthly bond purchases and more cheap loans for banks designed as an incentive for them to lend more but left policy unchanged in April.

While that massive stimulus programme may be stopping activity from slowing further, it is not boosting inflation.

Policymakers have so far failed to get inflation anywhere near their target of close to but below 2% – it once again fell below zero last month.

The latest PMIs showed firms cut prices for a seventh month and at the fastest pace in over a year.

“Whilst the near term indicators are that inflation is likely to remain weak it is unlikely the ECB will be forced into imminent action as it wants to see the effects of the past measures go through,” May said.

..