Digital money transfer companies including PayPal Holdings are rushing to grab a share of Australia’s $35bn remittance market, hoping to plug a vacuum left by the major domestic banks’ exit from the space last year.

US-listed PayPal intends to roll out its online remitting platform Xoom into Australia soon, senior executives told Reuters, while UK-based WorldRemit in April said it had chosen Australia as its Asia-Pacific base.

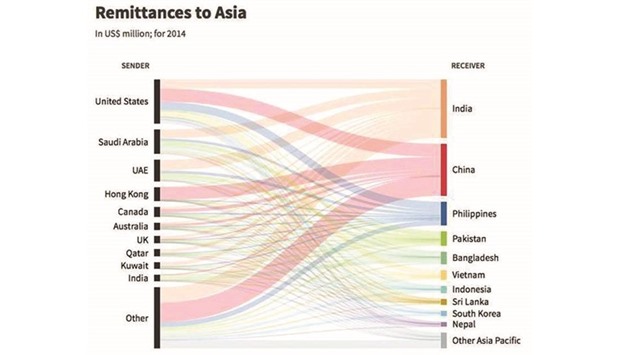

Australia is a fast-growing market for foreign money transfer operators thanks to a large migrant population with financial links to China, India, Southeast Asia, Africa, the Middle East, the Balkans and the Pacific Islands. One in four Australians has migrated from overseas, government data shows.

“This industry is belatedly moving online. Regulation and technology are driving this change,” said Ismail Ahmed, founder of WorldRemit, which is also expanding in New Zealand. The entry of global digital payments players comes amid growing concern in Australia that the industry was drifting underground, after the major banks closed the accounts of money transfer businesses due to compliance risks.

Accounting for about 80% of Australia’s banking activity, the country’s four major lenders felt particularly exposed to what regulators have identified as a high-risk sector for criminal activity like money laundering and terrorist financing, including transfers to militant groups like Islamic State.

But the international scale and reputation of major digital players means they are better placed to manage the regulatory and law enforcement scrutiny than smaller agents who previously dominated the sector, industry players say. Ahmed said he was scouting for acquisitions of niche players to further expand in Australia, already WorldRemit’s second-biggest market for outbound remittances. New Zealand, with a similar migrant population to Australia’s, is World Remit’s fastest-growing country for outbound transfers.

PayPal began making significant inroads into Australia after receiving a licence to hold funds on behalf of customers, although it cannot perform traditional banking services. It can also send money to under-developed countries with poor banking and mobile penetration.

“In some markets home delivery is important and in those markets we do offer home delivery, where a courier will show up, ring your doorbell and give you an envelope with cash,” said John Kunze, vice president of PayPal-owned Xoom.

While customers can use their bank accounts to transfer money overseas, it can be expensive and time-consuming. Australian banks charge up to A$30 ($22.94) per transfer, compared with A$5-A$8 charged by remitters.

The banks’ mobile applications are clunky compared with the simple interfaces offered by remittance newcomers like InstaRem or WorldRemit.

..