Qatar’s budget for 2016 foresees the “first deficit” in 15 years, coming in at 4.8% of GDP based on oil prices of $48 for a barrel, shows a new report.

The budgeted expenditures total QR202.5bn, which represents a 7.3% cut from the last full-year budget, said Samba Financial Group in a report.

The decline in projected revenues to QR156bn from QR225.7bn is due to a reduction in the oil price assumption from $65 in the previous budget, it said.

The Finance Minister reiterated this commitment to capital spending in the 2016 budget at the beginning of the year, saying that a ‘main goal’ during the budget preparation was to ‘ensure the completion and implementation’ of major projects in key sectors along with the projects related to the World Cup in 2022.

The budget now follows the calendar year, instead of running from April to March, as had been the case previously.

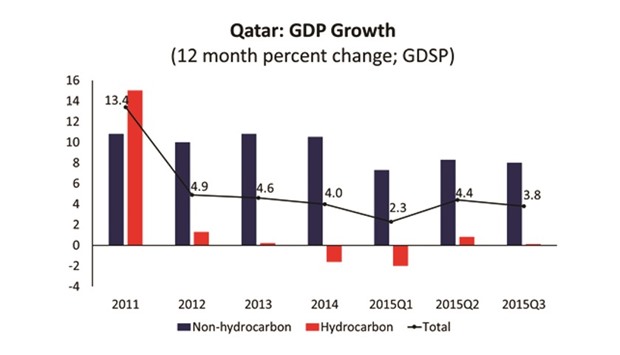

The announcement of a cut in spending on the previous budget and the recognition of a deficit is in line with the authorities’ “tougher stance” on recurrent fiscal spending, Samba said. “The authorities’ sense of urgency is vindicated by the latest fiscal figures, for the first three quarters of 2015, Government revenues have totalled QR159.7bn, whereas full-year revenue in 2014 stood at QR342.9bn,” the report said.

Although Samba still thinks that full-year 2015 figures will show a fiscal surplus, it sees a deficit of around 6% of GDP is in prospect in 2016. “There is already evidence of fiscal consolidation, the subsidy on petrol has been cut with prices rising 30%-35% in January,” Samba said.

The authorities decided to leave diesel prices untouched as a large amount of Qatar’s food and non-food requirements are imported by road from the UAE and Saudi Arabia by vehicles running on diesel, and a hike would thus add to food inflation.

The utility company Kahramaa has implemented a new “cascading” price structure for water and electricity supplied to homes and businesses, which will increase utility bills, especially for those who consume the resources so liberally, it said.

The Ministry of Finance also announced that any deficits would be funded entirely through debt issuance rather than the drawing down of reserves. It is the authorities’ view, Samba noted, that the reserves of the Qatar Investment Authority are to ensure future generations’ economic well-being and aren’t intended to be used as a stabilisation tool. Although, of course, the reserves are there if needed, the Government seem fairly staunch in their view that the QIA should be left to do its own thing.

According to Samba, it was worth noting that the government was comfortable managing debt – it has the experience of borrowing heavily to build up the LNG industry. “With this in mind, we expect debt to increase through to 2019, though the change in the debt to GDP ratio should be relatively small compared to others in the GCC,” Samba said.

BUDGET NEW