Public Private Partnerships (PPPs), arrangements between government agencies and private sector companies or investors to provide and maintain public assets and services are increasingly becoming popular, particularly in developing countries, to create infrastructure, utilities and healthcare facilities. In most cases, governments rely on the provision of private funding in exchange for fiscal benefits for the sponsor in the absence of sufficient sources of debt and equity financing on their own. However, the willingness of sponsors to invest in such public assets normally depends very much on their long-term risk-reward expectations – and they aren’t always met in countries with volatile economies or political instability.

Gaps in infrastructure financing could reach $70tn globally by 2030 as per estimates by the Islamic Development Bank Group, and increase further due to population growth, an increasing middle class and rapid urbanisation in developing countries. The need to address the shortfalls by looking into innovative solution has thus become obvious.

This has turned the attention to Islamic Finance as an untapped source of funding for cash-strapped governments seeking alternative sources to invest in critical infrastructure and services such as airports, toll roads, sea ports, independent power plants, hospitals and the like.

According to David Baxter, executive director of US-based Institute for Private Public Partnership, a globally active consultancy for PPPs, there are two reasons for the growing interest.

“The first reason is the vast untapped resource of investment dollars from the Middle East that are being underutilised for PPPs,” Baxter says, “while the second pressing reason is the need to provide investment opportunities to Muslim investors who are interested in investing in projects that are Shariah-compliant.”

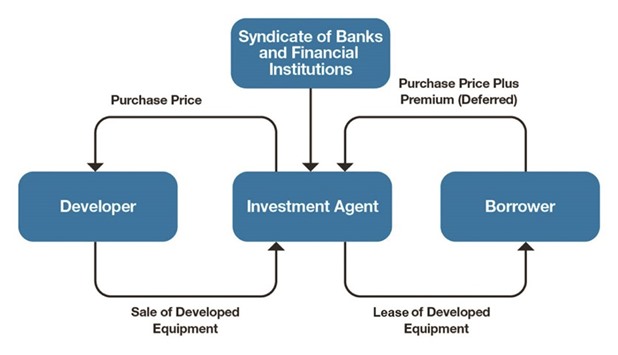

Additionally, two predominant Islamic finance structures are a perfect match for financing long-term PPP projects, namely ijara, a lease-purchase or operating lease model, and istisna’a, a long-term contract whereby a party undertakes to manufacture, build or construct assets and a client (in this case the government agency) can make deferred payments in instalments linked to project completion.

In Islamic jurisdictions, both models are commonly used for the construction of power plants, factories, roads, railways, schools, hospitals, buildings and residential developments, and the perception has come up that they work well with PPPs projects, too. Other methods of funding could include the classic Islamic profit-sharing model of mudharaba, the rent-to-own model of murabaha, the joint-venture or project partnership model of musharaka, and also classic sukuk or a combination of sukuk with istisna’a and other structures.

“Islamic finance can bridge the investment gap in the PPP investment market,” Baxter says, adding that “it is a viable and compatible source of funding for PPP projects focusing on building infrastructure that contributes to the common development goals of a community or country,”

The World Bank and the Islamic Development Bank in its recently launched initiative “Mobilising Islamic Finance” also embarked on the possibility of tapping Shariah-compliant funding models for infrastructure projects and other public facilities in developing countries.

“Many governments are now looking to understand the legal and regulatory issues relevant to the flow of Islamic financing and what project structures can or cannot work well with these features,” says Fida Rana, senior PPP expert at the Islamic Development Bank.

The initiative is also looking into special matters such as energy projects funded by both conventional and Islamic finance vehicles, trying to integrate these two financing classes in a single project. It also promotes the use of Islamic PPP finance for social projects that go beyond hospitals and schools and would support entire community-driven developments in poorer nations.

A typical istisna’a structure that can be used for financing PPP projects. The borrower (a government agency) leases the asset (product, service) once it is delivered to the lenders. The purchase price owed is repaid to the investors in instalments plus premium through a broker.