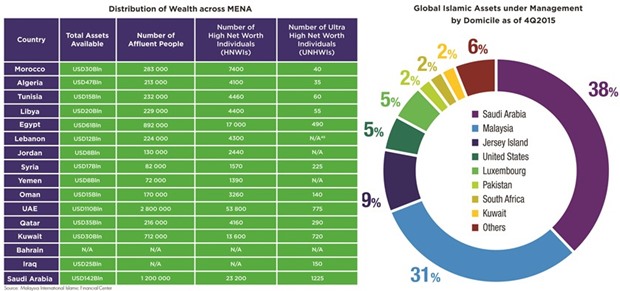

Growing demand for asset-based investments in times of fiscal insecurity in major economies in the world and the fact that still only a small portion of the estimated $11.5tn worth of wealth owned by Muslim individuals, institutions and governments is managed by Islamic financial institutions has turned the attention of investors – both Muslim and non-Muslim – towards Islamic wealth management. According to Malaysia-based International Shariah Research Academy for Islamic Finance, or ISRA, there is a lot of potential to tap for Islamic wealth managers: As of the fourth quarter of 2015, total global Islamic assets under management were “just” $58bn and the number of Islamic funds worldwide stood at a meagre 1,053. This compares to $56.4tn of wealth owned by all high-net worth individuals globally combined and to more than 9,200 investment funds in the US alone.

Thus, Islamic financial institutions and banks have made efforts to improve and expand the services offered under the label of Islamic Wealth Management, seen as a relatively a new operational focus for Islamic banks, as well as conventional banks with Islamic windows. Such services now include the employment of certified Islamic financial planners to plan and monitor investment strategies, schemes for high net worth clients based on Shariah-compliant asset and securities selection, takaful cover for wealth management products, Islamic money market investments, Shariah-compliant investment funds and trusts, including real estate investment trusts, structured products, forex trading, direct equity, estate planning services, the opportunity of placing funds in well-regulated foreign jurisdictions to help reduce systemic or macro risks and to optimize tax liabilities, as well as retirement planning and the protection of wealth through modern and effective risk management tools.

But fact is that most of the Muslim wealth is still managed by conventional banks through conventional banking products, say experts.

“About $9.5tn remain outside the global Islamic financial services industry that has just $2tn assets under management,” said Professor Humayon Dar, chairman of Edbiz Corp, a UK-based Islamic financial consultancy, at the International Forum on Islamic Finance 2016 held on February 9 and 10 in Khartoum, Sudan. “This is a huge loss to Muslims communities and Islamic banks,” he noted, adding that “Islamic banks have a role to play in extending the social impact of Islamic finance to the wider society.”

This could be reached by enhancing Islamic banks’ wealth management capacity, diversifying their product range in accordance with the risk appetite of increasingly sophisticated Islamic investors who currently have to resort to conventional wealth management products as they cannot find an equivalent Shariah-compliant product – with the result, according to Professor Dar, that around 70% of total Middle Eastern wealth is still channelled abroad to conventional asset managers, many of which are subsidiaries or ventures of Middle Eastern banks in jurisdictions such as Switzerland, Luxembourg or the Channel Islands.

Despite the obvious correlation between oil price and Islamic wealth and a slight slowdown in wealth accumulation among high net worth individuals in oil-rich countries as of recently, prospects remain strong as demand for Islamic wealth management is driven by growing interest from both Muslim and non-Muslim investors. The Malaysian International Islamic Financial Center, or MIFC, forecasts that Islamic assets under management will likely grow by around 5% annually to cross the $70bn-mark by 2019. It’s helped by stable demand from the strongest markets in the Middle East and Southeast Asia and the growing insight of large conventional banks in the West that Islamic wealth management is a huge opportunity as Islamic finance has become more than just a niche player on the market and an increasing number of wealthy Muslim Investors are looking to deposit their wealth in banks without having to compromise on their religious beliefs.

..