GCC states would gain little from a currency devaluation and are expected to draw on their large external savings to support their exchange rate pegs as necessary while pressing ahead with fiscal consolidation, Samba has said in its latest report.

GCC (Gulf Cooperation Council) exchange rate pegs have come under “speculative pressure” in forward markets, particularly in Saudi where foreign exchange reserves have fallen sharply, it said.

“Oil prices appear to have found a floor at around $30/barrel for Brent. This is way below levels expected by GCC states when prices first started to fall from $100/b back in mid-2014,” Samba said in its latest ‘GCC Chart Book’.

Average prices fell 43% in 2015 to $57/b, and are projected to be down another 25-30% this year.

With prices below the full cycle cost of production for many, there will be a recovery in due course. But in the meantime GCC states have to make sharp fiscal and structural adjustments, it said.

Perhaps against expectations, GCC governments have been quick to react to the new oil price environment by pressing ahead with much needed reforms to their generous welfare systems, most visibly by cutting back on energy subsidies. To varying degrees, there have also been sharp cuts in fiscal spending, and concerted efforts to raise non-oil revenues.

These are expected to lead to the introduction of a value added tax (VAT) throughout the region by 2018, and the sale of state assets, Samba said.

Despite these moves, the speed and extent of the oil price decline has pushed many into large fiscal deficits (15% of GDP in 2015), which will persist this year, before coming under control as prices pick up and fiscal consolidation measures take effect, the report said.

Low levels of government debt and large external savings provide scope to fund these deficits to varying degrees.

Most notable has been the resumption of domestic debt issuance by Saudi Arabia last year, with a first sovereign international bond issue planned for later this year.

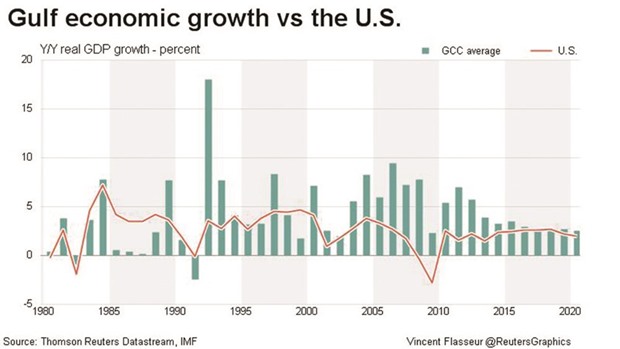

Reduced public spending, a shift to current account deficits, and a challenging external environment have weighed on growth, confidence, and GCC stock markets.

More frequent PMI data confirm that private non-oil activity has continued to slow through January.

Despite a deteriorating operating environment, GCC banks weathered through 2015 reasonably well, and remain well capitalised.

“However, deposit growth is clearly slowing, non-performing loans (NPLs) rising, and liquidity tightening, which will constrain future credit growth. Rising government borrowing will also reduce the amount of liquidity available for private sector lending, and financing costs are rising,” Samba said.

..