The US Federal Reserve (Fed) may press ahead with raising interest rates only if financial markets stabilise in the coming months, QNB has said in a report.

The turmoil in financial markets at the beginning of this year has prompted some to question whether the Fed should have increased interest rates in December. The markets have called into question the strength of the US economy and have been pricing in a higher risk of recession in the US, QNB said.

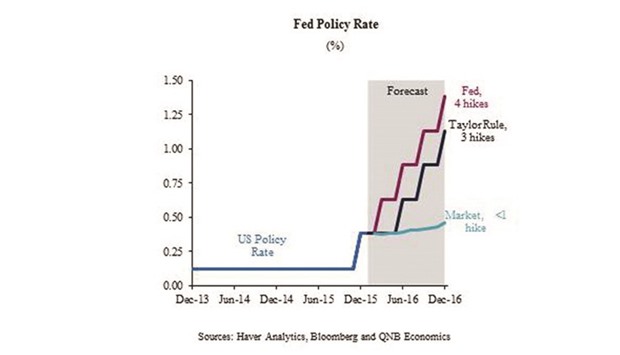

At the Fed’s policy meeting in December 2015, the last time it published its projections for the US economy, the Fed expected to increase interest rates four times in 2016, by 25 basis points each time. The state of financial markets and recent comments from Fed officials have prompted markets to price in less than one hike this year. This raises the question, who is right and how many times will the Fed actually raise rates this year?

The Fed chair Janet Yellen, has described a rule that she uses as a guide for interest rate policy, called the ‘Taylor Rule’.

The Taylor Rule is an equation that prescribes the central bank’s interest rate based on the amount that inflation and unemployment are deviating from their targets.

QNB said it uses the Taylor Rule and its economic projections for the US economy to determine the appropriate Fed interest rate at the end of this year.

As explained in its recent commentary, QNB expects the US real GDP to grow by 2.1% in 2016. This is below the Fed’s December projections for economic growth (2.4%), which makes sense given the recent weak economic data from the US.

As a result, QNB’s forecast for unemployment at the end of 2016 (4.85%) is slightly higher than the Fed’s December projection (4.7%).

With regard to inflation, the Fed’s preferred measure, which strips out the effects of volatile food and energy prices, has started to pick up in the second half of 2015, rising from a low of 1.3% in July to 1.4% in December. This remains well below the Fed’s target of 2%.

However, QNB expects inflation to continue its moderate rise in 2016 to reach 1.5% by the end of the year.

This is partly due to higher wages as the labour market continues to tighten. It is also due to higher expected healthcare costs.

A number of payments under the Medicare programme have kept healthcare inflation down in recent years, but this effect is expected to dissipate going forward.

Therefore, healthcare inflation (20% weight in overall inflation) is expected to rise during 2016.

With inflation at 1.5% and unemployment at 4.85%, the Taylor Rule, which combines both inflation and unemployment to come up with the optimal interest rate, recommends that the Fed’s policy rate should be at 1.1% at the end of 2016.

“This would imply three 25 basis point hikes this year from the current level of 0.375%.

Although this is lower than the four hikes that the Fed expected in December, it is still well above market expectations of less than one hike this year,” QNB said.

Although the Taylor Rule suggests that three rate hikes would be the optimal monetary policy this year, the Fed could deviate from this due to the current turbulence in financial markets and recent weak global economic data.

Both of these factors could be seen as risks to the US economy itself, but are not accounted for directly by the Taylor Rule.

Indeed, QNB said that in September 2015, the Fed decided to deviate from the Taylor Rule’s recommendation by keeping rates on hold due to concerns about the global economy and turmoil in financial markets.

“This suggests the Fed could continue to hold off from rate hikes for the same reasons this year. However, if financial markets stabilise in the coming months, then, we can expect the Fed to press ahead with raising interest rates,” QNB said.

FED