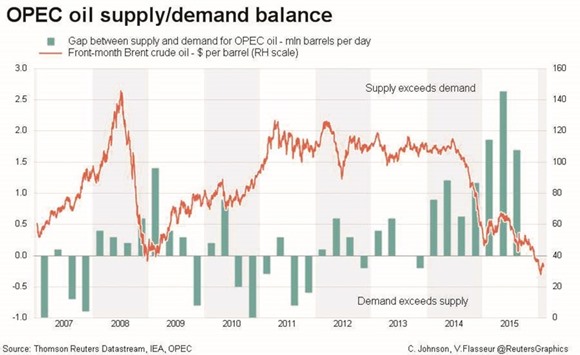

The global oil surplus will be bigger than previously estimated in the first half, increasing the risk of further price losses, as Opec members Iran and Iraq bolster production while demand growth slows, according to the International Energy Agency.

Supply may exceed consumption by an average of 1.75mn bpd in the period, compared with an estimate of 1.5mn last month, and the excess could swell if Opec adds more output, the IEA said. Iran raised production in January following the removal of international sanctions, Iraqi volumes reached a record and Saudi Arabia also ramped up output. The agency trimmed estimates for global oil demand.

“With the market already awash in oil, it is very hard to see how oil prices can rise significantly in the short term,” the Paris-based adviser to 29 nations said in its monthly market report. “In these conditions the short term risk to the downside has increased.”

Oil prices remain capped near $30 a barrel after slumping to a 12-year low in late January. While prices recovered on speculation that the Organisation of Petroleum Exporting Countries might agree to production curbs with non-members, “the likelihood of coordinated cuts is very low,” according to the IEA. No agreement to restrain supply emerged last week after Venezuelan Oil Minister Eulogio Del Pino toured oil capitals from Moscow to Riyadh.

Production from Opec’s 13 members climbed by 280,000 bpd last month to 32.63mn, the IEA said. That’s about 900,000 a day more than the average required from the group in 2016.

Iran expanded production by 80,000 bpd to 2.99mn in January after reaching a deal with world powers that lifted oil sanctions in return for limits on the nation’s nuclear programme. Iraq increased output by 50,000 bpd to 4.35mn and could raise that further, according to the IEA, which had predicted in October that the country would struggle to add new supplies. Saudi Arabia, Opec’s biggest member, boosted production by 70,000 bpd to 10.21mn.

The IEA lowered its estimates for global oil demand for last year and 2016, by 100,000 bpd, leaving the level of growth for this year unchanged at 1.2mn bpd to average 95.6mn a day. That growth is weaker than the five-year peak of 1.6mn barrels a day reached in 2015, amid slowdowns in Europe, China and the US. Oil inventories in developed nations increased in December, a month when they normally decline, by 7.6mn barrels to 3bn. That left stockpiles about 350mn barrels above average, according to the report.

Supplies outside Opec slipped by 500,000 bpd in January from the previous month, halting annual growth. While non-Opec production will drop by 600,000 bpd this year as the US shale boom sputters, the decline is “taking an awful long time to happen,” the agency said.

..