Emerging market stocks and oil-linked currencies fell yesterday, though for once the decline seemed to be the consequence rather than the cause of a sharp sell-off in the world’s most developed markets.

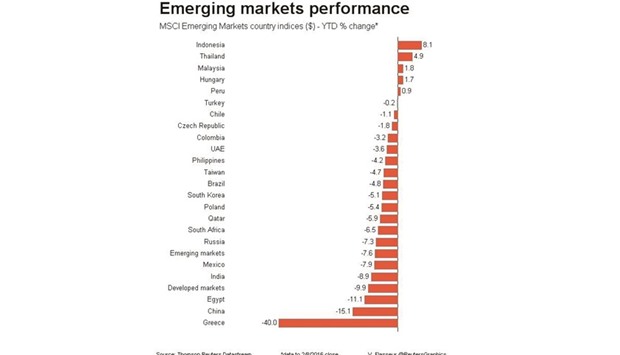

MSCI’s 23-country EM share index was down 0.5% and in the red for the second successive day, as investors began picking up the pieces after a European banks-driven rout on Monday.

Eastern Europe saw Czech, Hungarian and Russian stocks inch back into positive territory as a small rise in oil prices and dip in the euro eased the two big pressures weighing on their respective currencies recently.

Poland underperformed again, though. Stocks in Warsaw, which have bounced only half the 12% the rest of eastern Europe has gained since mid-January due to concerns over its new government’s plans, remained 0.6% lower.

The zloty, which has gone from being a relative resilient currency at the start of the year to being almost as sensitive as South Africa’s rand or Turkey’s lira, dipped back towards its lowest against the euro since 2011.

“It is fair to say markets are still fairly nervous,” Rabobank emerging market strategist, Piotr Matys.

“Most interesting of the FX market crosses at the moment is probably euro/zloty,” he added. “My concern is that the atmosphere in Polish politics will become even more toxic. When you have a volatile currency, investors are going to have a more cautious approach.”

Asian trading remained thin overnight due to China’s lunar New Year holidays but it was far from uneventful. Philippine stocks fell almost 2% as a 5.4% drubbing for Tokyo’s Nikkei sent shivers through the region.

With markets wobbling almost everywhere, focus was sharpening on a testimony by US Federal Reserve chief Janet Yellen with Washington politicians today.

US futures markets are pricing in barely one rate hike from the Fed this year, but any views she gives on the recent volatility in global markets will be highly sensitive.

The gap between what investors demand to hold emerging market countries’ bonds rather that ultra-safe US Treasuries has widened significantly due to the fall in US yields and nudged out again to 520 basis points.

Among currencies, Russia’s rouble remained down on the day but looked to have steadied against the dollar at 78.53 and at 87.80 versus the euro.

“The market is pricing in very dovish outcomes for central banks already, so they are finding it difficult to surpass these lofty expectations for further stimulus. Unless the Fed contemplates cutting rates it is very difficult for them to get ahead of the market here and you are seeing that reflected in risk assets,” said UBS EM strategist Manik Narain.

..