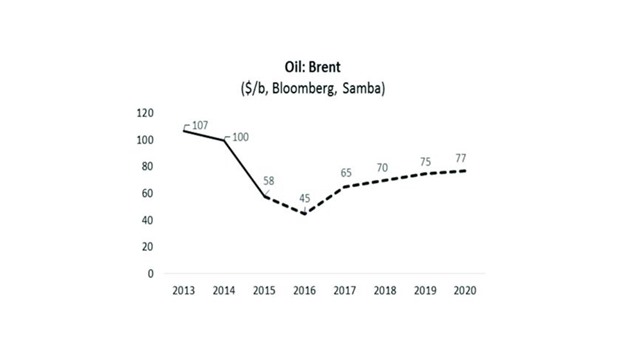

Brent crude is likely to average $65 a barrel in 2017 as the current prices are “far too low to spur” necessary investment, resulting in the “market rebalancing” eventually, a new study shows.

Samba Financial Group said the need to “work down the large stock overhang and absorb new Iranian supply will keep prices suppressed” this year, around $45.

Assuming global oil demand holds up, as Samba expects, this should allow for a rebalancing of market fundamentals later this year, which will set the stage for a price recovery in 2017. If this trend of rising demand growth and slowing supply continues, then Brent should be able to work its way back up towards $80 by 2020, the Samba study showed.

“This projection is relatively bullish, particularly compared with futures markets, and we recognise that there are large downside risks in the short-term, especially on the demand side,” Samba said.

However, current prices appear too low for medium or long-term market equilibrium: prices in the $30-$40 range are simply not high enough to make investment in new fields economically (in most cases).

Thus, unless there is a pick-up reasonably soon, the recent large investment cutbacks by international oil companies (IOCs) might be setting the stage for an uncontrollable price surge further down the line, Samba said.

Persistently low oil prices were supposed to bring a supply response from non-Opec producers, but this is happening more slowly than expected, and has been offset by surging Opec supply. As a result, the expectations that physical markets would start to rebalance during 2015 have had to be re-thought and most do not expect any significant adjustment until much later this year.

For the moment, stocks remain near historic highs and prices at a 12-year low. For all this, the demand outlook is not too bad.

Global oil demand staged a “healthy recovery” during 2015 to grow by around 1.5mn barrels per day (bpd). Lower oil prices and recovering economies helped drive an increase in OECD demand and, despite concerns over China and Emerging Markets, non-OECD oil demand also continues to grow.

"We expect that global growth will weaken somewhat in 2016, but assuming China avoids a hard landing oil demand growth should hold at 1.3mn bpd this year,” Samba said.

On the supply side of the equation, US shale output was volatile but “surprisingly resilient” in 2015, with producers slashing investment but eking out more from the most productive wells. These efforts can only go so far, and with the slump in investment and higher financing costs putting a strain on over-leveraged balance sheets, we think US shale output will go into reverse this year.

“The less nimble international oil companies (IOCs) have already shelved investment projects worth some 20bn barrels of oil, with more cancellations likely this year. Opec production is also likely to ease off somewhat this year. Saudi will fight to maintain market share in East Asia, and will cede little ground to fresh Iranian supply, but there is only so much additional supply that can be absorbed in current market conditions,” Samba noted.

Oil stocks remain near historic highs and prices are at a 12-year low.