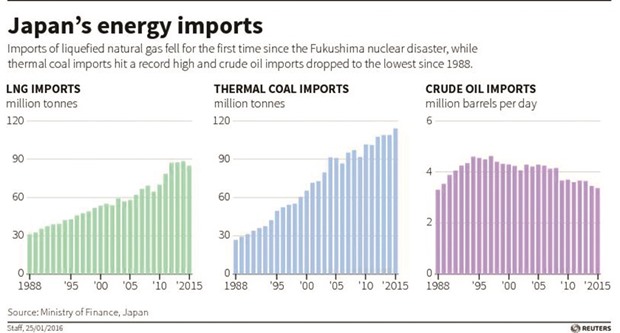

Japan’s 2015 oil imports fell to the lowest since 1988, reflecting the country’s declining population and low economic growth while at the same time its natural gas imports fell for the first time since the Fukushima nuclear disaster.

Yet in the same year that the world agreed to combat climate change, Japan’s utilities continued to increase the use of the cheapest but dirtiest fossil fuel, ramping up coal imports to a record.

Continuing a steady decline since the mid-1990s, Japan’s crude oil imports last year fell 2.3% to 3.37mn barrels per day (195.499mn kilolitres), official figures released yesterday showed.

Similarly, Japan’s power generation fell for a fifth straight year in 2015 to 866.26bn kilowatt hours, the lowest since at least 1998.

The declines reflect deep changes in Japanese society since an asset bubble burst in the 1990s and its population declines and people change the way they consume energy.

Young Japanese drive less than their parents, and many new cars are electric-gasoline hybrids, cutting oil

demand.

“The fall in consumption in Japan is mainly down to slower economic growth,” said Jeremy Wilcox, managing director of consultancy Energy Partnership. “At the same time, increased focus on energy efficiency is really starting to constrain imports,” he added.

Japan is also gradually closing down its oil-fired power stations.

“Japan’s energy market is entering a new phase.... Utilities are having to become more cost competitive. Running old steam turbine gas and oil units no longer makes sense,” said Michael Jones, senior analyst at energy consultancy Wood Mackenzie.

Japan’s changing energy profile has hit LNG the hardest, of which it is the world’s biggest consumer, using it mainly for power generation and heating. LNG imports fell 3.9% to 85.046mn tonnes in 2015 from a record 88.51mn tonnes the year before, marking the first drop in six years and the lowest

since 2011.

LNG usage should fall further as overall energy demand declines and the country reopens nuclear reactors.

This will put further pressure on LNG prices that have already tumbled by two-thirds to under $6 permn British thermal units since 2014 as supplies soar from new exports from Australia and the US.

“LNG demand is getting hit from all sides,” Jones said. “Power demand is weak, solar capacity is increasing at breakneck speeds, nuclear capacity is returning, and coal-fired generation is rising.” As a result, LNG imports are expected to fall to a five-year low of 79.6mn tonnes in the year starting in April, according to the government-associated Institute of Energy Economics Japan.

Japan’s LNG imports surged following the meltdowns at the Fukushima Daiichi nuclear plant in 2011 and the ensuing shutdown of all reactors, pushing utilities to the brink of financial ruin as gas prices surged.

To save cash, Japan’s utilities are increasingly switching to cheap coal.

In 2000, Japan’s coal demand was only slightly bigger than LNG consumption, around 60mn tonnes a year versus some 55mn tonnes for LNG, but gas use has now stalled while coal imports have nearly doubled since then.

Thermal coal imports rose 4.8% to a record 114.145mn tonnes in 2015, the same year as the world reached a climate deal to combat global warming caused in large part by coal burning.

“The rise in coal imports comes down to economics,” said Energy Partnership’s Wilcox.

“The figures are consistent with the government’s 2030 basic energy plan which aims to reduce LNG usage and maintain coal,” said Tom O’Sullivan of energy consultancy Mathyos Japan. “This would seem to contradict the aims of the COP21 (Paris) conference in December that sought to reduce global carbon emissions.”

..