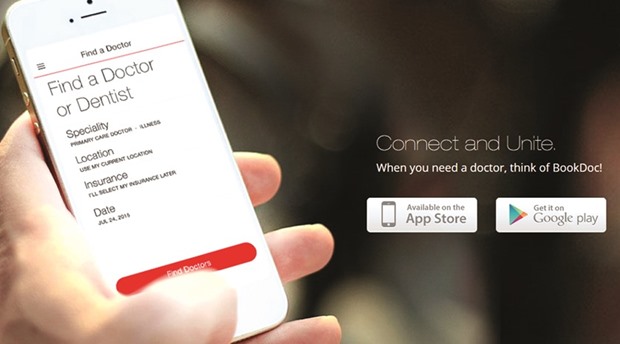

Users of BookDoc can search for and book appointments with medical doctors, and employers can monitor their staff’s health and medical coverage, as well as medical benefits.

The small, but oil-rich Sultanate of Brunei Darussalam at the northern tip of Borneo is normally known for big-ticket investments of its oil money into five-star hotels and luxury real estate around the globe, as well as commodities, finance and securities with holdings in the US, Japan, Europe and Southeast Asia.

But now, it seems to have discovered the appealing world of startup financing. Brunei’s royal family, precisely Prince Abdul Qawi, aged 41, a nephew of Sultan Hassanal Bolkiah and eighth in line to the throne in Brunei, together with other unnamed investors raised an reportedly seven-digit US dollar amount in a seed funding round for Malaysian healthcare startup BookDoc, the first such investment by Brunei’s royals.

This is remarkable as the Prince was so far known for brick-and-mortar investments such as top real estate in Australia, furniture manufacturing and as Starbucks partner in Brunei, among others, including investment holdings. But this time it is a debut for him to enter the startup space.

BookDoc, founded in July 2015 in Malaysia and officially launched just a few months ago in October 2015, is an app for people to search and book medical doctors. Adding to this, it allows employers monitor their staff’s health and medical coverage, as well as manage their medical benefits. Its founder and CEO is Chevy Beh, former managing director of Malaysia’s BP Healthcare Group, and co-founder is Joel Neoh, founder of Groupon Malaysia and ex-CEO of Asia Pacific for Groupon. Beh says that BookDoc is now — apart from Brunei’s Prince — backed by a diverse group of investors “from entrepreneurs to seasoned healthcare and insurance professionals, bankers, regulators as well as information and communication technology professionals.”

In fact, known investors in BookDoc are a former chairman of the Malaysian Communications and Multimedia Commission, a former managing director and CEO of RHB Bank and Hong Leong Bank, a former director of the Armed Forces Health Services of Malaysia, a senior Ministry of Health official, and a couple of other high-ranking Malaysian individuals.

In the short time of its existence, BookDoc so far established strategic tie-ups with prominent specialised hospitals in Malaysia, namely the National Heart Institute, the largest private hospital in Malaysia in terms of revenue and bed size, Sime Darby Ramsay Healthcare, a joint venture between Sime Darby, the largest business conglomerate in Malaysia, and Ramsay Health Care, the largest hospital group in Australia, as well as Malaysia’s National Eye Hospital. Meanwhile, BookDoc ventured into Singapore and Hong Kong and is now planning to roll out its services in Indonesia, Thailand and the Philippines, and probably also Brunei, in the near future. In Malaysia, the expansive start-up recently entered a cooperation with ride-hailing startup GrabTaxi to provide physical transportation for its users to doctors’ and hospital appointments, says Beh. Among its corporate clients are so far the regional branch of Frost & Sullivan, University of Nottingham Malaysia Campus, Tricor Group, an Asian telecom firm and a regional logistics company.

“We have now greater financial flexibility to seek out long-term strategic investors which could complement our future business growth,” Beh said, indicating that he would welcome other prominent investors for his venture, be it from Asia or the Middle East.

Apart from expanding within Southeast Asia, BookDoc said it will use the money raised to increase the number of staff, fund the second phase of its technological development and strengthen its internal infrastructure. According to its own statement, it has received the “highest seed funding valuation as well as pre-seed funding valuation in the technology start-up history of Asia.”