Bloomberg/London

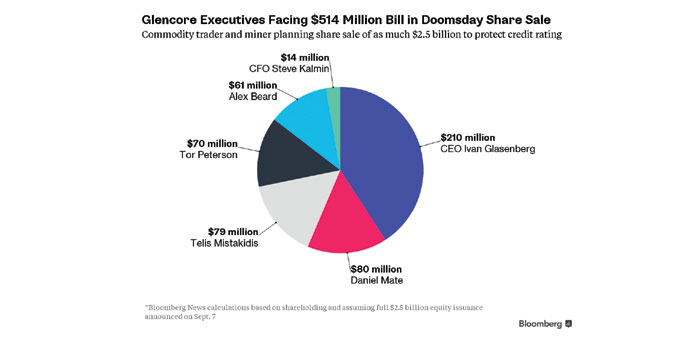

Glencore’s billionaire chief executive officer Ivan Glasenberg is on the hook for as much as $210mn of the Swiss commodity trader’s looming $2.5bn sale of new shares aimed at staving off a potentially disastrous credit rating cut.

The 58-year-old accountant turned coal trader, who has worked for the company for more than 30 years and is its second-largest shareholder with 8.4%, has vowed to maintain his stake by taking part in the sale. Glencore is considering a range of options for offering stock, including a simple share placement, a rights issue or a mandatory convertible bond.

The sticker price for Glasenberg of $210mn assumes Glencore raises the full amount.

The heads of its metals and energy units, Telis Mistakidis, Daniel Mate, Alex Beard and Tor Peterson, and chief financial officer Steve Kalmin also face significant costs to uphold the company’s commitment that they won’t dilute their holdings.

The combined bill for the executives plus Glasenberg may be $514mn, assuming the sale reaches $2.5bn, Bloomberg calculations show.

Glencore announced this week a raft of measures to shore up its balance sheet, which is bulging under a $30bn debt pile, including a pledge to cut borrowings by about a third to protect its BBB rating at Standard & Poor’s.

Kalmin told analysts on Monday it was clear investors were running “doomsday scenarios” on Glencore’s business and that its new debt strategy would address “any balance sheet concerns in some of these more drastic downside scenarios that some people were articulating, however fantasy-like.”

The potential cost of the share purchases pales against the payouts Glencore’s senior executives have received since the company went public in a $10bn initial public offering in 2011.

Glasenberg’s maximum participation represents about 27% of the $770mn of dividends he’s received during the past four years — including the 6 cent-a-share payout announced last month that has yet to be paid.

Glencore has scrapped its next two dividend payments as part of its debt reduction strategy, saving about $2.4bn.

While the final form of the share sale hasn’t been decided, Morgan Stanley and Citigroup will underwrite 78% of the planned offering. Glasenberg, Kalmin and several board members will take up the remaining 22%, the company said in a statement on Monday.

Glasenberg is worth about $2.7bn, according to the Bloomberg billionaire’s Index. That’s slumped 51% this year amid a rout in the company’s share price. At the time of Glencore’s IPO, five of his fellow executives had stakes in the company valued at more than a billion dollars. Now Glasenberg is the only one.

Peter Grauer, the chairman of Bloomberg, the parent of Bloomberg News, is a senior independent non-executive director at Glencore.